Airbnb: Scaling Curation

Last week, many of us received Twitter or email alerts announcing that Airbnb will be going through a major redesign. CEO Brian Chesky, described it as “the biggest change to Airbnb in a decade.”

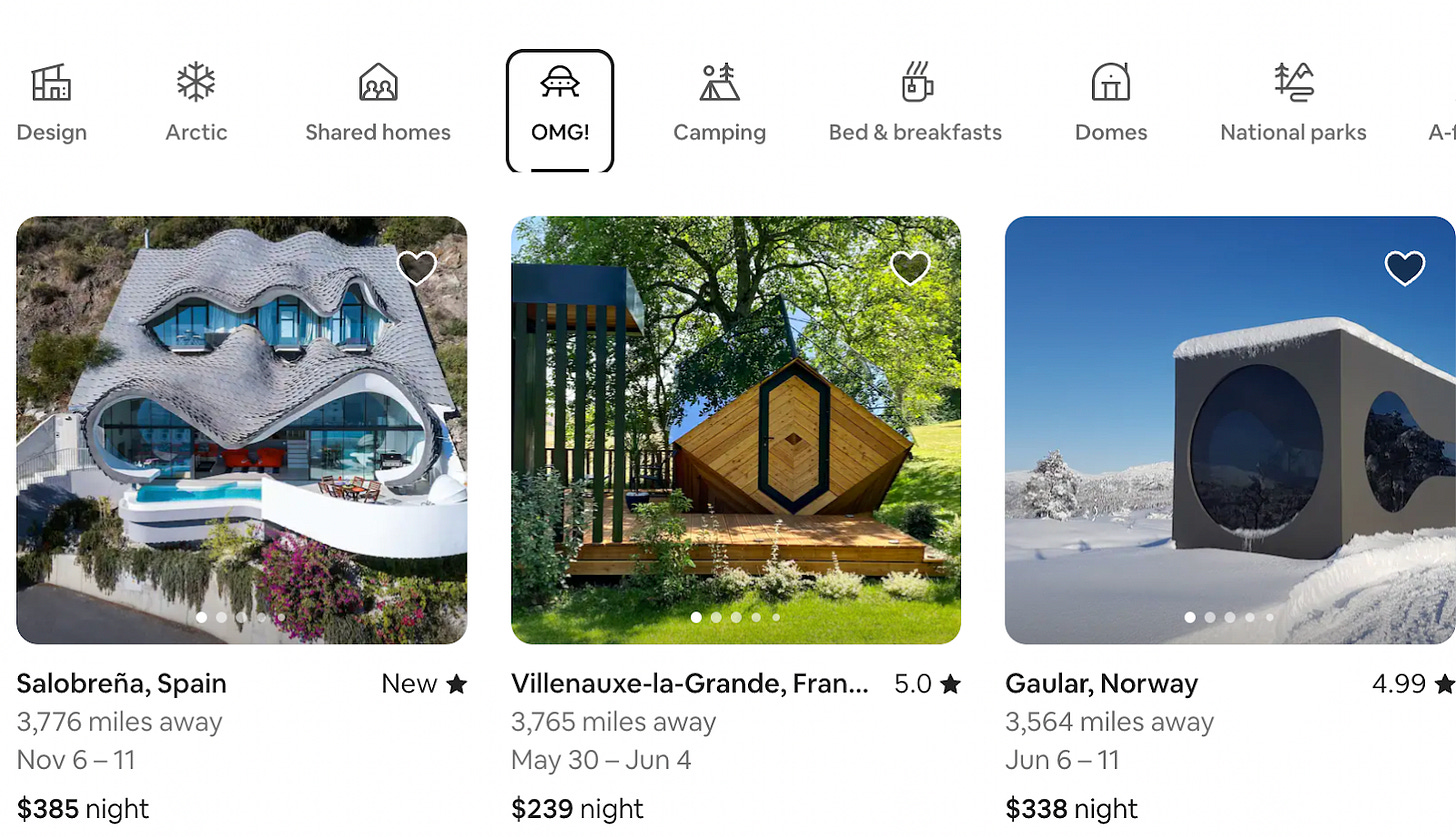

The main change is the ability to search for homes through a different set of filters. In particular, users will now be presented with 56 categories, organizing homes and apartments based on their style, location, or proximity to a travel activity.

From the image below, it’s evident that some of these categories are obvious (such as National Parks and Design), while others less so; the Arctic, Shared Homes, and OMG! being the most interesting ones.

Some people found the announcement interesting, some found it disappointing (given the hype), and some found it gimmicky.

I actually think it’s quite exciting and shows an effort to solve an important issue that Airbnb suffers from: it’s no longer the only and best option for every type of stay.

Scaling Interactions

For most firms, the main growth-limiting factors are resources and demand. Assuming you can generate enough demand, you are always going to be restricted by your resources: people, processes, cloud, inventory, etc.

For a platform-based firm, this is not the case. Airbnb doesn’t own any of the resources that create value for its customers. So one way to describe the constraint is to think of the supply side as a constraint and try to increase it (and this is definitely a valid way), but it’s only part of the problem (and the solution).

One of the first principles of platform economics is that the platform doesn’t bear the cost of production (or creation) of the product or services it offers. It is in the business of enabling interactions rather than creating (or producing) them.

For many of these platforms, the amount of potential “producers” is usually quite unlimited. Ask yourself: how many people can drive you from point A to point B? Quite unlimited. How many people own an apartment in a certain area? Quite unlimited. How many people can teach a course on “Scaling Operations”... Only me (that was a trick question to see if you are still with me).

The question is not so much on how many producers actually exist, but how many of them are on the platform, and how many of them are actually matched with those who need this product or service.

In other words, platforms should focus on enabling frictionless interactions while thinking about how they enable the core interaction.

Specifically, every platform has a value unit, which is what is being exchanged: a tweet (on Twitter), a ride (on Uber), a stay (on Airbnb). The core interaction is the set of activities needed to enable these interactions. In turn, interactions are broken down to the following activities:

Creation: where the producer offers/creates the value unit (i.e., the ride or the stay).

Consumption: where the consumer “buys” or uses what is being offered (i.e., the customer stays at a home or hails a ride).

Curation: which refers to the process by which the consumer and producer are matched.

The book Platform Revolution points out that in order to scale a platform, firms need to make these activities easy. In other words, the quantity and quality of these interactions need to be increased. The quantity, by making it easy to create and consume, and the quality by making curation more effective. The network effects of the platform get fulfilled when producers and consumers interact.

This is what it would look like for Airbnb:

Creation: making it easy for people to list their homes and apartments. Consumption: making it easy to rent a home or apartment. Curation: making good recommendations and allowing the search process to be as effective as possible.

Throughout the years, Airbnb has done a great job in facilitating these interactions. For example, Instant Booking has made it easier to “consume,” Smart Pricing has made it easier for users to list and price their home correctly, and the ability to get a professional photographer has had a similar impact.

Airbnb’s Issues

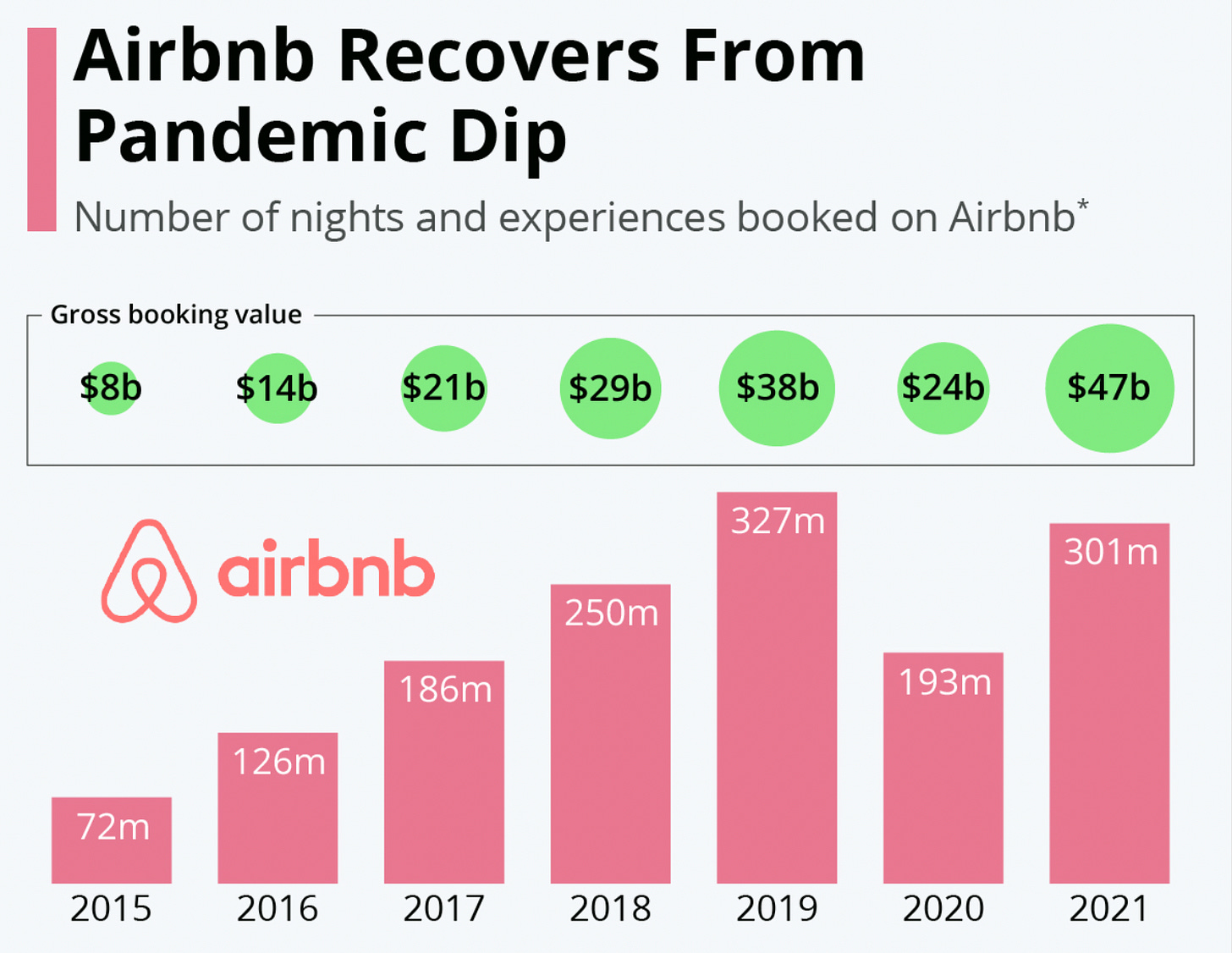

But Airbnb has been somewhat struggling both during and after COVID.

Don’t get me wrong, the firm has been growing and has managed to regain a momentum similar to what it had before COVID even though the number of experiences and nights has not fully recovered.

But these numbers only tell part of the story.

Airbnb has been suffering from a supply shortfall.

A deeper look reveals that the gap between available and active listings has been widening (even before COVID).

And to make matters worse, many owners have been reluctant to bring their listings back online after COVID:

On the consumer side, Airbnb also lost its step.

Personally, I love Airbnb, and prefer it over a hotel for family vacations.

But when Airbnb started, and for many years, it was much cheaper. This is not necessarily the case, as the following data shows. In fact, in many areas, hotels are now a much better deal.

It’s true that Airbnb provides options in locations where there are no hotels, but these days Expedia and Booking.com list homes and apartments as well.

Airbnb is not always the best solution for more niche bookings either. When booking a chalet for ski vacations in the Alps (I know, first world problems), we prefer to use one of the local sites to find a house since it provides us with information that Airbnb doesn’t, i.e., distance to the shuttle, distance to slopes, and the distance to the best baguette in town; the important things.

The Redesign

And this is where the redesign is going to have a significant impact.

I don’t think Airbnb is the best or the only solution for any specific geography (since many of these homes are listed on multiple platforms), and it can’t solve its supply issue by forcing people to list their apartments or homes either.

But it can help curate an existing set of houses across geographies, and create a new way for owners to differentiate their properties, not only within their geographical location, but across geographies.

Let me explain.

Last summer, my family and I decided to take a hiking vacation. We didn’t really care where in the US, but we wanted a multi-family home close to hiking spots, close to a river or a lake, and with space for work (you know, for those addicted to emails…referring to a friend).

It proved to be extremely difficult to find such a place.

In a world where more people are working from home, location may no longer be the No.1 criteria for choosing a vacation home. Proximity to activities and quality of WiFi might be more important. For example, I am not sure why a host shouldn’t be obligated to upload a bandwidth test.

With its redesign, Airbnb is trying to create a competitive advantage through a new type of curation, which will no longer be a geography-first curation, but an experience-first curation. While Airbnb was always about variety, this is a new way of organizing its variety.

The value unit is still the same: the stay. But the redesign allows the owner to list their property in a new way (e.g., design), which was hard to do until now, and potentially encourage new owners to list their homes. But the heart of it is the ability to curate using this new taxonomy. Much more fitting to a world that blurs the lines between travel and work, I think.

It’s clear that this taxonomy is only the beginning. I believe we will see new opportunities and a new variety of homes, possibly including a category for “Work From Everywhere,” offering the ability to test a home’s bandwidth and sort by time zones to accommodate time differences (so you can hit some slopes before your first meeting or be ready for a hike as soon as you pack it in for the day).

Over the years, Airbnb has tried to enhance its marketplaces in various ways, like adding experiences, but hasn’t touched on the core product. The new curation function, with its ability to create a new taxonomy of differentiation, might indeed be the most interesting development the firm has made so far.

The full effect of the redesign may not be seen immediately since the current supply is still based on the old sorting mechanism, but it’s interesting to see whether there will be a new equilibrium with a new supply and even more novel categories.

Airbnb said on their earnings call two weeks ago that their global listings were above 6 million and the highest they have ever been so the data from the graph in the post is a couple of quarters stale. But the point made is valid and important because their bookings have grown much faster than supply and it will become a gating factor to growth if they can't grow supply at a rate similar to what they would like to grow bookings. The bookings growth during the past two years has been predominantly been driven by the US as EMEA has lagged and APAC has lagged even more given more of a reliance on cross border travel and more intense COVID lockdowns. The company believes that supply will come back in those markets as restrictions ease and supply will also return in urban US markets i.e. NYC and SF as demand picks back up. The pricing study is interesting -- I would have thought the pricing gaps were still higher than they are displayed in that chart. There are probably a few more ways to cut the data given the greater availability of options on Airbnb and difficulty in ascertaining what is "comparable value" pricing from hotels vs. Airbnbs. How the company will perform in a recession and if they will fall victim to the demand "mean reversion" that has impacted Zoom, Netflix, Peloton, etc also seems very relevant to the business performance over the next couple of years. I am a bit skeptical that this product change will have much of an impact on usage (but that could be because I am biased by using Airbnb typically when I have a location and date already in mind). I was surprised to hear you like Airbnbs as I thought you would prefer the "consistency" of the hotel experience. You should try New Hampshire for your summer hiking vacation! Lots of good hiking options (not sure about the wifi)