Two important food news this week: Argentina is banning the export of beef, and US pizzerias are running out of pepperoni.

Both are related and unrelated to COVID. Both demonstrate how complex and convoluted supply chains have become, as well as the macroeconomic implications they have.

Let’s beef up this story a bit (if you don’t like dad jokes, this is not the post for you). What has been causing these issues in Argentina?

The starting point for this is quite surprising:

“Argentines, who traditionally have been among the world’s most voracious red-meat eaters, have seen their intake reduced steadily amid declining income and diet changes. A prolonged economic slump means annual per capita beef consumption has fallen to 48 kilograms (106 pounds), the lowest level in data on record, and far less than the 2009 peak of 69 kilograms, according to beef industry group Ciccra.”

While beef consumption has been declining in Argentina, beef remains a disproportionately preferred ingredient of the food basket. Argentina is the biggest consumer of beef per capita. The US, which follows, consumes around 80 pounds of beef per capita. But it goes deeper. As the article hints, in Argentina, beef also has cultural importance as the traditional family meal. Thus, the impact:

“With red meat prices up about 65% annually, easily outpacing 46% inflation, the government of President Alberto Fernandez is suspending beef shipments by the world’s fifth-largest exporter for 30 days.”

Global Demand for Beef

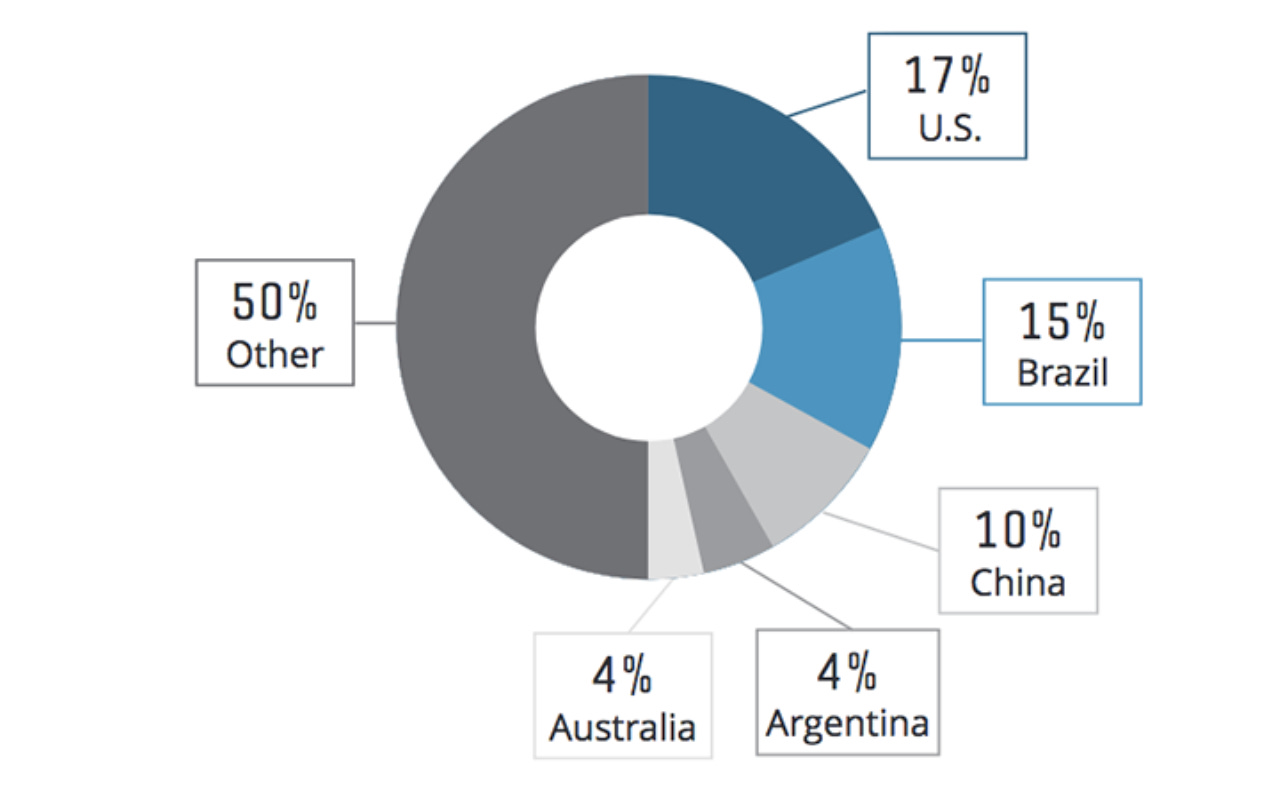

The upward pressure on pricing is coming from global demand. What has sparked the global demand for beef? The story is, again, not so simple. But similarly to, and across different stories and products, there is a Chinese factor and an American one.

While beef consumption has traditionally been relatively low in China, the last few years have seen an increase in demand. In particular, China has been ramping up imports of both meat and animal feed to offset a decrease in hog herds there, due to the African swine fever.

“China’s hog industry was devastated by African swine fever in 2018 and, while herd sizes have recovered since then, a recent resurgence drove up pork imports to a record last month. Prices have fallen, however, as the culling of herds increased domestic supply.”

Of course, this demand in China has been directed not only to Argentina but also to the US:

But this brings us to the US aspect of the story. The US is still the biggest producer of beef:

And this is where COVID comes in. During COVID, beef supply chains were disrupted in two ways: First, restaurants closed, moving the distribution center of gravity to grocery stores. Second, meatpacking and processing plants had to shut down since workers there were highly impacted by COVID, given their working conditions.

To summarize: As demand in the US and Asia soared, the impact on consumers in Argentina was more pronounced than on their US counterparts. But this is primarily looking backward and trying to explain why the Argentinian government is banning (at least for 30 days) the export of beef.

As we look toward the next few weeks and months, the situation is only going to become worse. In the US, even though poultry has become more available than any other type of meat, by volume, the expenditure is still higher on beef. In 2018, US families spent $961 on meat, 26% of that on beef, and 18% on poultry. Another important trend is that during the years before COVID, 44% of all food spending was being allocated to food delivery or dining out. Now that more and more people are being vaccinated and states are easing restrictions, restaurants are opening, and we expect to see even more pressure on demand.

The Beef Supply Chain

Can the supply chain respond to it? Unlike many products, the supply chain for anything that is related to livestock is not very flexible. This is primarily due to the lead time needed to raise animals.

But this is exacerbated by the structure of the supply chain. The beef supply chain has 4 stages: agricultural production, processing, distribution, and retail:

At least in the US, the power structure is not evenly distributed and is actually concentrated around the distribution and retail stages, resulting in this disparity between the cost of livestock and the prices to consumers: “Since March 12, the wholesale price of beef has shot up 43%, according to USDA. Cattle prices have risen only 5%”

And the impact goes beyond beef:

"The cost of pepperoni jumped 60% over the past five weeks for one independent pizzeria in Indiana, JPG Managing Director Glenn Pappalardo said. A deli in the state is only getting about 40% of the chicken it has ordered from suppliers, he said, while flour and tofu are out of stock about half the time."

Prices and Supply Chains

I am not sure if what we are seeing here is true inflation or just volatility, but one thing we know is that overreacting to volatility will only result in more volatility. We are going to see more shortages which will increase prices further, which, in turn, will increase volatility even further.

Some people call it the reverse bullwhip effect. If the bullwhip effect means that small disruptions on the consumer side are going to cause amplified demand volatility the further you move away from the consumer end of the supply chain ( as in the semiconductor industry), the reverse bullwhip effect implies that price volatility will increase the closer you are to the consumer side.

It’s hard to say whether prices are the cause or the effect here. Higher prices are the effect of scarce capacity or a surge in demand. But prices may be the cause for some of these disruptions, as with beef prices in Argentina. We tend to think of prices as what may help stabilize markets. In the case of supply chains, however, they may do the opposite.

If you think this is going to end soon, as Lumber prices go up, people build fewer Chicken processing plants, and as demand for chicken meat is only increasing in the US, we will see a significant shortage there over the next few years.

Finally, let’s take a tally of all the factors involved: US, Argentina, China, Africa, beef, chicken, hogs, and Lumber. If someone tells you the global supply chain is going through a big decoupling, that’s just a bunch of baloney.

Sounds like lots is at steak here, especially in this bull market.