The smell of pumpkin spice is back in the air, which means it’s time to talk about Starbucks again. As long-time readers know, I tend to focus on timely topics, and what could be more fitting than discussing the company's new CEO?

Brian Niccol, former CEO of Chipotle, will be assuming the same role at Starbucks effective September 9th, and the media are mostly focusing on his salary and choice to remain in California, far from the firm’s headquarters in Seattle. But the headlines are missing a much bigger story—what Niccol can bring to the iconic coffee brand and how it might redefine Starbucks as we know it.

For those familiar with Niccol’s background, his leadership can potentially be transformative. This is not just another executive reshuffle. Niccol is the man who turned Chipotle from a faltering fast-casual chain into a streamlined, highly-profitable powerhouse. His tenure at Taco Bell showcased his ability to innovate and drive growth, albeit in ways that often favored speed and efficiency over the experience of traditional dining. As Niccol moves to Starbucks, it’s worth considering what he might add to the brand and what might be lost—or changed—along the way.

Let’s delve deeper.

Good Coffee isn’t the Focus, But Maybe That’s Okay

I’ve always been upfront regarding my opinion on Starbucks coffee: while some love it and others just tolerate it, the reality is that it’s over-roasted and mediocre. Yet, Starbucks has never been about coffee. Its success hinged on creating an experience; that “Third Place” between home and work where people could gather, linger, and connect.

Under Niccol’s leadership, it’s unlikely that Starbucks will suddenly become renowned for the world’s best coffee. He’s not a coffee connoisseur or a culinary expert; he’s a strong operator. And while improving the coffee might seem logical, it’s not where Niccol’s strengths lie. Instead, we should brace for changes that might make Starbucks more efficient, more varied in its offerings, and—perhaps—less about the leisurely coffee experience.

Starbucks has long positioned itself as the “Third Place,” and this concept has been integral to its identity, shaping everything from store layouts and overall customer experience to asking people for their names (only to misspell them). Yet, in recent years, there’s been a noticeable shift. The rise of mobile orders, drive-thrus, and a focus on speed have begun to erode this foundational idea.

I have written before about the fact that part of the issues Starbucks faces with its employees around unionization is that the work moved from the realm of hospitality and customer experience to an assembly line with billions of variants, and is continuously on the clock due to the nature of mobile orders.

Given this history, Niccol’s appointment at Starbucks raises questions about the future of the “Third Place” concept. Will Starbucks become more like Chipotle—a place focused on speed, convenience, and operational efficiency?

The signs suggest so. The pandemic already accelerated trends that pushed Starbucks in this direction, with mobile orders and drive-thrus becoming more central to its business model. Niccol’s background makes him the perfect candidate to double down on these trends, potentially transforming Starbucks into a brand that prioritizes quick and accurate service over a welcoming atmosphere.

A Shift from Hangout to Handoff: The Niccol Playbook

Let’s take a closer look at Niccol’s time at Chipotle to understand what he might bring to Starbucks. Niccol joined Chipotle when it was reeling from a series of food safety crises, which severely damaged its reputation.

Many expected him to rely on his marketing expertise, honed at Taco Bell, to revitalize the brand. However, what Niccol brought to Chipotle was something much more profound (at least in my opinion)—a focus on operations.

He recognized that marketing alone couldn’t save Chipotle. The company needed to regain customer trust and improve its operational efficiency to survive and grow. One of Niccol’s first moves was to introduce a second production line in most restaurants dedicated to fulfilling digital orders. He also expanded drive-thru lanes (also known as “Chipotlanes”). These small operational changes significantly impacted service times and allowed Chipotle to handle a larger volume of orders without sacrificing quality. He also introduced digital pickup shelves, making it easier for customers to grab their orders without waiting in line. These changes, though seemingly minor, were part of a broader strategy to streamline operations and enhance customer experience through efficiency.

They brought Chipotle back to profitability but moved it closer to a fast-food identity, far removed from its original image as a healthier, fresher alternative.

Niccol also knew Chipotle needed to innovate its menu to keep customers engaged. But rather than overhauling the entire menu, he focused on incremental innovation—adding quesadillas, testing new items like avocado tostadas, and launching a limited-time brisket option. These additions weren’t just about variety; they were about driving more frequent visits and increasing customer spend.

These strategies proved successful, helping Chipotle recover and thrive in a highly competitive market.

Did he help Chipotle scale?

Let’s look at the data.

Above, you can see the revenues and costs since 2014. You can see the crisis the firm was in when Brian Nicol joined as CEO. You can observe that the firm grew its top line while expanding its margin significantly during his time. This is not trivial for a mature firm in a mature industry where most of the growth comes from opening more locations, which is not a scalable way to grow.

So, what does all this mean for Starbucks? If Niccol applies the same principles, we might see Starbucks stores becoming more efficient, emphasizing on speed and convenience. Expect more innovations aimed at driving foot traffic and increasing spend per visit—perhaps more digital order options, expanded drive-thru capabilities, and even new menu items designed to appeal to different customer segments at various times of the day.

Does a CEO Really Matter? If so, what Type does Starbucks need?

But we're placing a lot of weight on a new CEO, and it has long been debated whether CEOs truly influence a firm's performance.

A key finding from the literature is that CEOs differ significantly in how they make decisions and allocate their time, which ultimately affect firm performance. According to studies by Bandiera, Hansen, Prat, and Sadun, CEOs exhibit substantial variation in both their day-to-day behaviors and strategic decision-making approaches. For instance, some CEOs focus heavily on internal meetings and operational tasks, while others delegate more and concentrate on high-level strategy.

The paper “CEO Behavior and Firm Performance” explores this impact by developing a novel method for measuring and analyzing CEO activities across a large sample of companies.

This paper, which seeks to answer how CEOs’ behavior of influences the performance of the firms they lead, aims to understand whether CEOs who engage in more strategic, high-level activities (“leaders”) drive better firm performance compared to those who focus more on day-to-day management tasks (“managers”).

The motivation behind this study stems from the growing body of literature suggesting that a CEO’s identity and behavior impact firm performance significantly. Previous research has been limited by small sample sizes and the difficulty of quantifying CEO behavior in a way that can be systematically analyzed. This study, however, attempts to bridge that gap by creating a scalable methodology that can capture and analyze the diverse activities of CEOs across different firms and industries.

The authors develop a new survey tool that collects high-frequency, high-dimensional diary data on the daily activities performed by CEOs. This data is processed using a machine learning algorithm that categorizes CEOs into two behavioral types: “leaders” and “managers.” The key innovation here is the ability to shadow CEOs’ diaries rather than the CEOs themselves, allowing for the collection of granular data at scale. The study focuses on CEOs of manufacturing firms across six countries: Brazil, France, Germany, India, the UK, and the US.

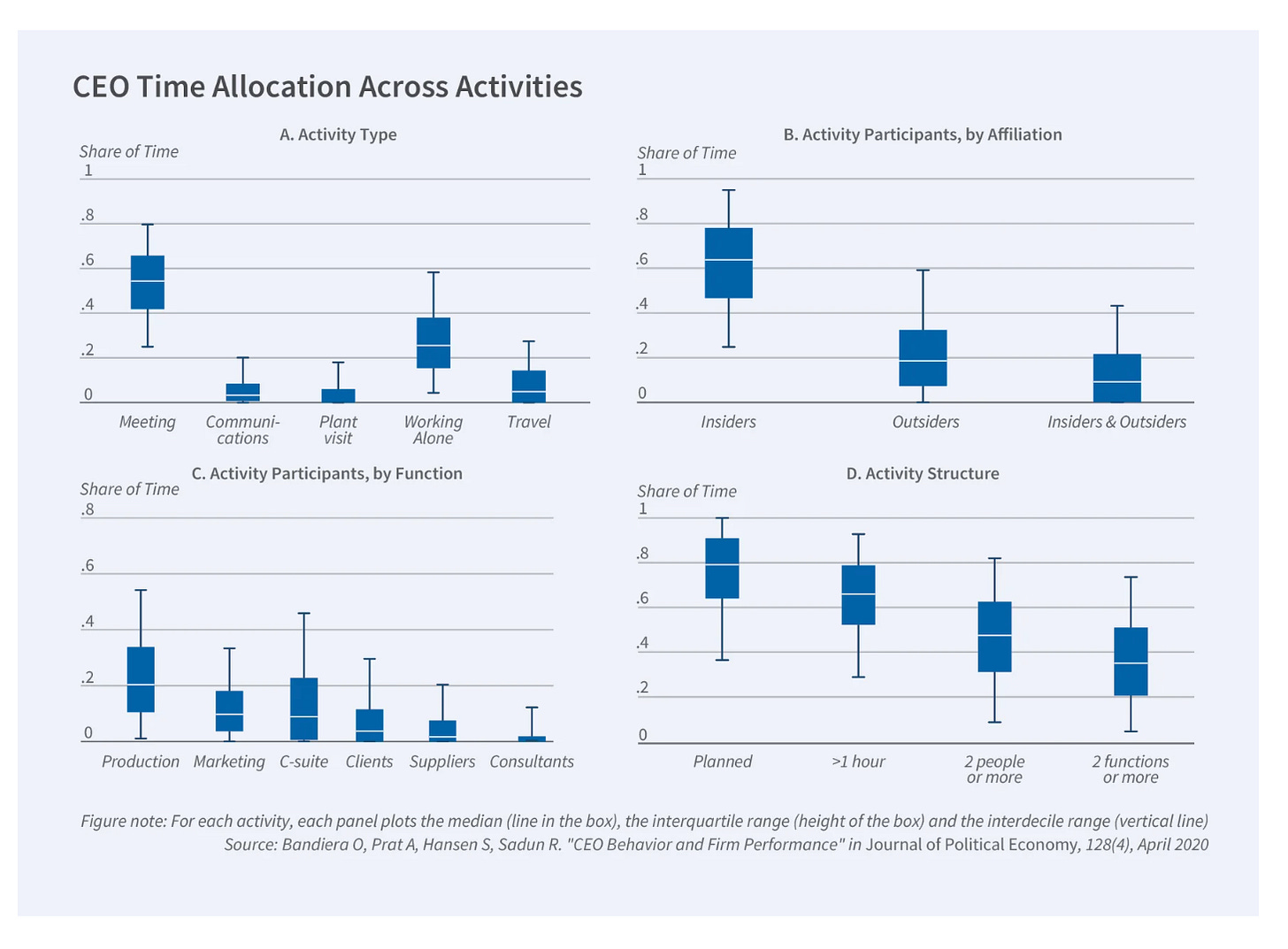

The dataset includes information from 1,114 CEOs, covering 42,233 activities that span an average of 50 working hours per CEO. The data was collected through daily phone calls with either the CEOs themselves or their personal assistants, providing detailed insights into how CEOs allocate their time across different types of activities.

You can see the breakdown here:

The study finds that CEOs who engage more in leadership activities, such as high-level meetings that span multiple functions, tend to lead firms that perform better. It is particularly noted that it takes approximately three years for a new CEO’s influence to significantly impact firm performance. Additionally, the study reveals that the observed productivity differentials are primarily due to a mismatch between CEO behavior and firm needs, rather than an inherent superiority of leadership-focused CEOs in all contexts.

Niccol’s track record suggests he’s a hybrid. At Chipotle, he demonstrated strong managerial skills, streamlining operations and improving efficiency. But he also showed leadership, guiding the company through a period of crisis and repositioning it in the market. This duality might be exactly what Starbucks needs right now. The company has faced criticism for its declining customer experience, particularly as it has struggled to balance the demands of speed with the desire to maintain its “Third Place” identity.

Starbucks needs someone who can manage its day-to-day operations while also providing the visionary leadership needed to navigate the challenges of a rapidly changing market. Niccol could be the right fit, particularly if he can find a way to blend the efficiency of a fast-food chain with the unique, welcoming atmosphere that has been Starbucks’ hallmark.

The Future of Starbucks: A New Kind of Coffee Shop?

As Niccol steps into his new role, the big question is what kind of Starbucks will he build? Will it be a place where customers still feel welcome to sit and stay awhile, or will it become more like a fast-food outlet, where the focus is on getting in and out quickly? Most likely, the answer lies somewhere in between.

Niccol’s approach at Chipotle shows that he values efficiency and scale, but he’s also aware of the importance of brand identity. At Starbucks, this could mean a move toward a more streamlined operation, emphasizing digital orders and drive-thru services. However, it could also mean a renewed focus on customer experience, albeit in a different form—perhaps through enhanced digital interactions, personalized service options, or new products that cater to changing tastes and preferences.

In the end, Niccol’s tenure at Starbucks could mark the end of the “Third Place” as we know it, but not necessarily the end of Starbucks as a beloved brand. Instead, we might see the emergence of a new kind of Starbucks, one that blends the speed and convenience of fast-food venues with the experience and consistency that has always set it apart.

Bottom Line: A New Chapter for Starbucks

Brian Niccol’s arrival at Starbucks signals a significant shift in the company’s direction. His operational expertise could bring much-needed improvements to the customer experience—perhaps at the expense of the cozy, welcoming atmosphere that many have come to associate with Starbucks.

As for the coffee, Brian, please don’t change it. I still want to have something to tease Starbucks about!

Spot on, Professor. Really interesting to see how the pivot to operational efficiency drove Chipotle's profit margins—but marked a fundamental identity change, embracing the "fast food" role.

I came to a similar prediction about Starbucks recently, too: "They’ll fully cede the expensive, niche end of the market, but in retreating from having comfy cafes at which to sit and linger, they’ll have lower costs, and be able to operate and run in even smaller store footprints than currently." (https://yallstreet.substack.com/p/mermaid-misfiring)

Great post. More marketers should consider how operational efficiency can be a product feature. An old but great example is how Dell’s ability to fill made to order PCs within ~3 days in the 1990s let them compete with retail.

My only small quibble is that I’m not sure that the “third space” experience and operational efficiency are in conflict for Starbucks. The burden of filling mobile orders has really hurt the in-store experience. I suspect that they’ll figure out how to better meet the requirements of mobile order customers and better segregate the “factory” feel of that process from what it feels like in the store. I suspect that the in store experience is still critical to new customer acquisition and important to profitable growth.