One App to Rule Them All: Airbnb Declares War on Hotels, Hosts, and Its Own Simplicity

This Week’s Focus: Airbnb's Pivot

Airbnb recently announced some major changes aimed at tightening control, boosting revenue, and reshaping user experience. The changes include stricter rules against off-platform interactions, a redesigned app, new experiences, and a push for verified quality listings. The update sparked a 6% drop in Airbnb’s stock, signaling concern among users and investors alike. This week, we explore the timing, the risks and rewards of this shift, and whether Airbnb’s vision of becoming a full-service “travel super-app” will stick—or backfire.

A couple of weeks ago, Airbnb introduced several significant changes to its platform and policies, impacting both hosts and guests.

Key changes include stricter enforcement of off-platform fees, new services and experiences, a redesigned app, and a new focus on verified quality listings. The firm’s stock price dropped 6% following the announcements, reflecting the negative sentiment among both Airbnb’s users and investors.

In today’s article we talk about these imminent changes, we explore why Airbnb chose to implement them now, and examine how they will impact both hosts and guests.

Let’s get comfortable and begin our discussion.

Airbnb’s Growth Trajectory (2008–2024)

Airbnb’s journey from a tiny startup in 2008 to a global travel behemoth by 2024 is reflected in its explosive growth across all key metrics. Starting with a single booking in 2008, the platform reached 1M cumulative bookings by early 2011, doubled to 10M nights booked by mid-2012, and has since grown exponentially. Annual usage skyrocketed from ~72 million nights and experiences booked in 2015 to nearly 0.5 billion in 2023—almost 7x increase in eight years. By 2024, over 490 million nights were being booked yearly on Airbnb, with cumulative guest arrivals surpassing 2 billion since its launch.

Accompanying the surge in nights booked, Airbnb’s user and host base grew into one of the world’s largest two-sided networks. There are over 150 million registered users globally (with approximately 145 million having participated as guests). On the supply side, Airbnb hosts now exceed 5 million, collectively offering over 8 million listings worldwide across 100,000 cities. For context, in 2010, there were only a few thousand hosts—demonstrating how Airbnb scaled its participants dramatically. Cumulatively, Airbnb hosts welcomed more than 1.5 billion guest arrivals by the end of 2023.

Financial metrics mirror this growth. Airbnb’s gross booking value (GBV)—the total dollar value of bookings on the platform—jumped from $8B in 2015 to $73.3B in 2023, as both the number of bookings and average prices increased. Annual revenue grew in tandem, from under $1B in 2015 to nearly $10B by 2023. Even the COVID-19 downturn in 2020 (when revenue dipped to ~$3.4B amid travel shutdowns) proved only a temporary setback. By 2021, Airbnb’s revenue rebounded to $5.99B and then hit a record $8.4B in 2022, before rising 18% year-over-year to $9.9B in 2023.

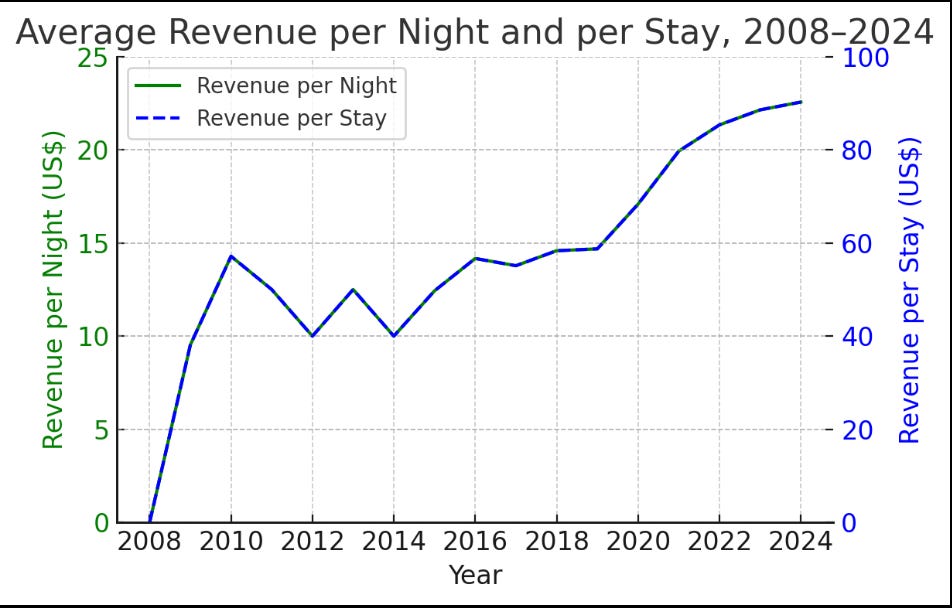

Notably, Airbnb’s revenue per transaction has increased over time, driven by rising average booking values and slightly higher take rates. In 2018, the average nightly rate on Airbnb was about $117; by 2023, average daily rates had grown to roughly $160+ (as travel demand shifted toward longer stays)—contributing to a 13–14% commission take rate on a higher base.

Airbnb’s fee revenue per night booked nearly doubled from around $12 in 2015 to over $22 by 2023 (calculated from $9.9B on 448M nights). With an average stay length of ~3.9 nights in 2023, this implies Airbnb now earns on the order of $85+ per booking in fees on an average trip.

Most importantly, the company manages to convert a large share of this revenue into profit and cash. Airbnb’s gross margins exceed 80%, since its costs to facilitate a booking are relatively low. In 2023, its gross profit per stay was on the order of ~$70 (implied by ~87% margin on ~$85 revenue per stay), and free cash flow per stay approached ~$30. Airbnb’s asset-light marketplace model yields substantial cash generation: in 2024 the company produced $4.5 billion in free cash flow (40% of revenue), highlighting that each incremental booking contributes robustly to the bottom line.

In summary, by 2024 Airbnb achieved both massive scale (nearly half a billion nights/year) and strong unit economics (double-digit dollars of profit and cash per booking).

However, one can already see how the gross margin per stay has been stagnant for several years, while the revenue per stay is starting to flatten as well. Both curves demonstrate the diminishing returns to scale, and thus diminishing network effects.

This context is essential for understanding the strategic shift underway in 2025. Having reached this scale, Airbnb is now undertaking major platform policy changes aimed at securing its future growth and optimizing the quality of its core business.

Core Interaction and Platform Scaling Theory

To analyze why Airbnb is altering its platform rules in 2025, it’s useful to view the situation through the lens of platform strategy theory. At the heart of any platform is the “core interaction” —the fundamental producer-consumer exchange that the platform enables.

In Airbnb’s case, the core interaction is connecting hosts with spare space to travelers needing accommodation. A host creates a listing (a home to rent), the platform curates and facilitates discovery/trust (via search algorithms, reviews, payments, etc.), and a guest consumes the offering by booking a stay. This create–curate–consume sequence is Airbnb’s engine of value creation.

According to the Platform Scale and Scaling Manifesto frameworks (Choudary et al.), growing a platform business requires scaling both the quantity and the quality of its core interactions.

Quantity comes from network effects—attracting more hosts and more guests to drive more bookings. Quality comes from improving the experience and outcomes of each match—ensuring good trust & safety, low friction, transparency, and satisfaction for both sides. Platform theory holds that a platform should prioritize the health of its core interaction above all, as this drives long-term engagement and a competitive moat. Features or policies that enhance the core interaction (either by increasing its frequency or its value) strengthen the platform, whereas anything that degrades it (e.g., distrust, disintermediation, poor experiences) can undermine the network.

Airbnb’s growth between 2008 and 2024 was largely a story of scaling quantity: rapidly expanding to new markets, onboarding millions of homes and travelers, and achieving high booking volumes. In the early years, Airbnb was relatively “open” and growth-hacking oriented.The focus was on acquiring users and listings, sometimes at the expense of strict rule enforcement—hosts often listed extra fees in descriptions, communicated with guests freely, or even completed repeat bookings off-platform. Airbnb tolerated this to encourage adoption and since the supply side is what drove the market, policies were overly relaxed to accommodate hosts.

This strategy succeeded in reaching critical mass (Airbnb now has a dominant share of the home rental market, handling >20% of global vacation rental bookings). However, as a platform matures, the strategic emphasis shifts from pure growth to optimizing the quality and profitability of interactions. In Airbnb’s case, this pivotal year is 2025—the company is tightening platform policies to “perfect the core service” (as CEO Brian Chesky has described it) and to ensure its core interactions are maximized in both volume and value on the platform.

The so-called “Scaling Manifesto” for platforms would suggest that Airbnb’s next chapter must focus on deepening network effects and preventing value leakage. The company must lock in the interactions between hosts and guests so they continue to occur through Airbnb (maintaining quantity), and it must enhance trust, transparency, and ease of use to keep those interactions high-quality (thus driving repeat usage and justification for Airbnb’s fees).

Every policy change can be viewed in light of these goals: does it increase the number of bookings on the platform and/or improve the experience of those bookings? Airbnb’s 2025 strategic moves—from banning off-platform transactions to enforcing fee transparency—are clearly designed to answer “yes” on both counts, as we explore next.

The 2025 Policy Shifts: Off-Platform Deals, Fees, Communication, and AI

Airbnb is implementing a set of updates to its Terms of Service that significantly tightens platform control. Hosts and guests are now strictly prohibited from conducting any part of a transaction off-platform—including pet fees, cleaning charges, and security deposits. All costs must be declared and processed via Airbnb’s system, and any fees not built into the booking interface are disallowed.

This move, if successfully enforced (and this is a big if) ensures that Airbnb captures the full financial flow of each transaction—no more side-deals or informal payments—and can apply its commission to every dollar exchanged. It’s a direct bid to reduce revenue leakage and standardize the booking experience.

These changes are accompanied by a policy of full price transparency: guests now see the total cost of a stay—including all mandatory fees—up front. Airbnb’s goal is to eliminate “junk fees” and the frustration of bait-and-switch pricing, where a $100 listing balloons to $150 at checkout. This aligns with consumer protection trends and reinforces trust in the platform. Airbnb has also eliminated various workarounds—like asking for reviews off-platform or adjusting bookings informally. Any change to a reservation must go through Airbnb’s official tools, keeping the entire lifecycle of the transaction within its ecosystem.

On the communications front, Airbnb has banned hosts from asking for guest email addresses, external app registrations, or reviews on other platforms. Messaging must stay within Airbnb, and contact sharing is heavily policed. Even common host practices, like sending a PDF welcome guide via email, can now trigger penalties.

To enforce these policies at scale, Airbnb is leveraging AI to monitor all host–guest communications for violations. The system flags or penalizes violations automatically, creating a tightly governed environment.

Strategically, these policies mark a shift from Airbnb’s growth-hacking roots to a more disciplined phase. The rationale is twofold: improve the quality and trust of core interactions, and fully monetize Airbnb’s massive scale. By forcing all payments on-platform, Airbnb increases its effective take rate without raising headline fees. With nearly 500 million annual bookings, even a small percentage of recovered leakage adds up to hundreds of millions in potential revenue. While these moves risk alienating some hosts—especially professionals used to more flexibility—Airbnb is betting that its network size and demand concentration will prevent meaningful attrition. The company is tightening its grip not just to ensure consistency and safety, but also to pave the way for a broader strategy that includes services, curated experiences, and deeper user engagement.

Disintermediation on Airbnb and Strategic Platform Risks

Many of these changes target Disintermediation (or “platform leakage”) —when hosts and guests meet through Airbnb but arrange future stays off-platform to avoid fees. This behavior directly threatens the platform’s commission-based business model.

Indeed, Airbnb’s fee structure (roughly ~3% paid by hosts and ~14% by guests per booking) provides a monetary incentive to bypass the intermediary.

Disintermediation is the “Achilles’ heel” of any platform marketplace, contributing to the failure of some early platforms (e.g., Homejoy cleaning service). To protect revenues, Airbnb has long employed governance measures like concealing contact information until booking and warning users about off-platform risks. However, researchers note that the very trust and information quality which make a platform successful can also facilitate leakage: once a host and guest know and trust each other (e.g., via positive reviews), they are far more likely to “ditch” the platform and transact directly. In other words, providing too much information or reputation transparency can backfire by lowering the perceived risk of an off-platform deal.

Recent empirical research has attempted to quantify Airbnb’s disintermediation problem. A 2022 study by Lin et al. combined Airbnb booking data with mobile geolocation analytics to detect unregistered stays and found that approximately 5.4% of Airbnb stays in Austin, TX were taken off-platform. This provides a concrete (if conservative) measure of revenue leakage.

The same study examined Airbnb’s countermeasures and found mixed results. Notably, enabling Instant Book (which allows guests to book without back-and-forth messaging) significantly reduced off-platform bypassing by about 9% —presumably by removing the need for lengthy pre-booking conversations. Likewise, the adoption of Airbnb Plus (a program requiring hosts to meet higher quality standards and pay an inspection fee) led to a ~6% drop in disintermediation rates. The authors interpret this as Airbnb Plus “locking in” hosts to the platform via quality certification and investment, increasing their commitment to on-platform bookings.

In contrast, two hallmark Airbnb policies—the Superhost badge (a reputational reward) and information concealment (masking phone/email before booking)—showed no significant impact on preventing disintermediation.

In short, lowering transaction friction and raising platform-added value appear more effective at keeping bookings on Airbnb than blunt information blackouts or status badges.

These findings carry important governance implications for hospitality platforms, suggesting that platforms like Airbnb must move beyond simple punitive or deterrence tactics and instead align incentives to discourage off-platform deals.

Direct enforcement is difficult. While Airbnb and similar platforms threaten to ban users who arrange off-platform deals, detection is imperfect—and strict penalties can backfire. Heavy-handed governance creates a dilemma: it risks alienating high-value hosts and guests, and may simply drive covert behavior elsewhere.

Expanding the Core: Airbnb Services, Experiences, and the All-New App

Concurrently with tightening its existing home-rental business, Airbnb in 2025 is launching major expansions to its platform’s scope—moves that reimagine what Airbnb offers to both travelers and hosts. Airbnb introduced three big new initiatives: Airbnb Services, a revamped Airbnb Experiences, and a redesigned Airbnb app to integrate homes, services, and experiences in one place. This strategic expansion marks Airbnb’s attempt (yet again) in evolving from a pure accommodation platform into a more comprehensive travel and lifestyle platform.

“Seventeen years ago, we changed the way people travel… Now you can Airbnb more than an Airbnb.” —Airbnb CEO Brian Chesky, May 2025

Airbnb Services is a curated marketplace for on-demand offerings like in-home chefs, massages, and photography—available not only to travelers but also to locals in 260 cities. These “Services hosts” are vetted by Airbnb for quality, professionalism, and licensing, with many drawn from elite backgrounds (e.g., Michelin-starred chefs, certified trainers). All bookings and payments are handled on-platform. Airbnb’s goal is to compete with hotels on amenities—without owning infrastructure—by letting users customize their stays. This positions Airbnb against local gig platforms like TaskRabbit, but with a unique travel overlay: these services are deeply integrated into the Airbnb trip-planning flow, supporting its push to become a full-stack “super-app.”

Airbnb has also relaunched its Experiences platform at global scale, now spanning 650 cities with a renewed emphasis on quality curation. Experience hosts must be approved based on local expertise, guest reviews, and compliance with Airbnb’s new standards, with underperforming listings subject to removal. Offerings include architectural tours, cooking classes, and cultural workshops designed to go beyond generic tourist traps. A new social layer lets users see who else is attending, message fellow guests, and stay connected—creating a network effect around shared experiences. Importantly, locals are encouraged to book too, increasing the frequency and depth of user engagement.

These additions are tightly integrated into Airbnb’s redesigned app, where users can now book homes, services, and experiences in one seamless flow.

Strategically, Airbnb is layering new interactions, which they hope to gradually make part of their “core,” on top of its home rental engine. These initiatives are supported by the changes that Airbnb is implementing in 2025—banning off-platform transactions, enforcing fee transparency, and deploying AI moderation—to ensure that these high-touch verticals stay compliant, trustworthy, and monetizable. The tighter vetting of providers and in-app integration aren’t just product upgrades—they’re essential infrastructure for Airbnb’s next phase as a curated, high-frequency, multi-service ecosystem.

Airbnb Experiences: Why it May Work This Time—and Why it Still Might Fail

The relaunch of Experiences is another indication of how Airbnb is making a strategic shift from a lodging marketplace to a broader travel platform. The initial launch of Experiences in 2016 struggled, contributing less than 3% of revenue by 2019, and was deprioritized during the pandemic. This time, Airbnb is embedding curated Experiences across 650 cities directly into its app, supported by AI-driven recommendations and quality screening. Their ambition is to scale not just more transactions, but more types of interactions—trip planning, activity booking, and everyday leisure.

The logic is clear, but the execution is complex. Experiences are fundamentally harder to create, curate, and consume than lodging. A spare room exists whether booked or not; a cooking class, by contrast, must be scheduled, staffed, and executed well—each time. Unlike static listings, Experiences are dynamic, operational products with high potential for friction: cancellations, mismatched expectations, or host quality variance. Curation is also not trivial. Vetting for skill, reliability, and guest fit at scale—across cities, cultures, and categories—requires sustained oversight, and Airbnb has little room for error given its brand promise of trust and quality.

Consumption also poses barriers. Unlike lodging, which is a trip necessity, Experiences are discretionary. Booking them requires intent, time, and attention. Many travelers prefer spontaneity or use other channels (Google, concierge, friends). Embedding Experiences in the app improves discoverability, but changing behavior is difficult—especially if users think of Airbnb rentals primarily as a place to sleep. In short, Experiences could increase user value and platform depth—but only if Airbnb can solve for consistency, convenience, and conversion. Without that, it risks becoming a high-effort feature with low payoff, just like the first time.

Competing with Hotels, Super-Apps, and the Experience Economy

By making these strategic changes in 2025, Airbnb is positioning itself in a competitive landscape that goes beyond just peer-to-peer home rentals. It’s useful to examine how these moves stack up against hotels, “super-apps,” and the broader experience economy—three domains that Airbnb increasingly overlaps:

Hotels: Airbnb is now directly challenging hotels by bundling lodging with high-touch services like daily cleaning, spa treatments, and in-home chefs through Airbnb Services. This allows guests to enjoy hotel-like amenities in unique, private spaces—often with more variety and personalization than traditional hotels can offer. With full fee transparency and upsells built into its platform, Airbnb not only neutralizes hotels’ advantages, but positions itself as offering “the best of both worlds,” combining home comfort with curated service.

Super-Apps and OTAs: Airbnb’s redesigned app now integrates homes, experiences, and services—mirroring the strategy of Asian super-apps like Meituan. This allows Airbnb to compete with OTAs (online travel agencies) and lifestyle platforms by keeping more of a traveler’s journey inside its ecosystem. With a large base of accommodation users to cross-sell to, and AI-enabled data on user behavior, Airbnb can scale new services faster and smarter than most competitors. The more on-platform interactions occur, the better its data loop and user retention.

Tapping the Experience Economy: Millennials and Gen Z spend more on meaningful activities than on things, and Airbnb is meeting that shift with curated Experiences and Services. Cooking classes, cultural tours, and wellness offerings are now as central as lodging. This not only diversifies revenue but strengthens Airbnb’s brand as a lifestyle platform. To maintain quality and margins, Airbnb is using vetting, AI enforcement, and tighter control—growing both defensively (against leakage) and offensively (toward higher trip value per user).

Airbnb’s recent moves play a dual role, both offensive and defensive: expanding into new markets like local services and tours to fuel the next growth phase as its core lodging business matures, while also strengthening its platform to prevent erosion of its current business from host disintermediation or negative user experiences. It’s notable that Airbnb’s stock market performance and valuation (around $85B market cap in late 2024) are predicated on it being a high-growth, high-margin tech platform. To justify that, Airbnb must keep finding growth and maintaining margins—strategic changes addressed by capturing more revenue per booking and expanding the total market (Total Addressable Market, TAM) it pursues.

Conclusion: Scaling the Platform’s Quantity and Quality

Airbnb’s 2025 strategy is portrayed by its founders as ambitious: tighter control over its core interaction, expanding into services and experiences, and capturing more value per trip. By banning off-platform payments, enforcing price transparency, and embedding AI-driven oversight, it’s aiming to plug revenue leaks and build user trust—but at the cost of host flexibility and goodwill.

The vision is to transform Airbnb from a booking utility into a travel super-app—where homes, chefs, massages, and tours all live under one roof. If users embrace it and service quality holds, Airbnb could grow stickier, more profitable, and harder to replace.

But the risks are real. Airbnb is moving into crowded, operationally complex markets and asking hosts to play by tighter rules. Success hinges on flawless execution and user adoption. If either falters, Airbnb may find itself with more features—and fewer friends.