This Week’s Focus: Skiing, Strikes, and Exclusivity

This week, we explore the evolving dynamics of the ski industry, with Vail Resorts as our primary focus. While a wage dispute at Park City Mountain in Utah has caused operational challenges, the broader story lies in the consolidation of ski resorts under a few major corporations and the resulting transformation of skiing from a recreational activity into an exclusive luxury.

In contrast to the U.S. model—where profitability often comes at the expense of inclusivity—Europe’s decentralized ownership fosters competition and accessibility. By examining Vail Resorts’ financial and operational strategies, particularly its Epic Pass as a driver of demand and revenue stability, we consider how these trends shape the skiing experience and ask whether skiing can remain a joy accessible to all or continue to drift toward exclusivity.

It feels fitting to write about skiing, firstly because how would you know I ski if I didn’t write about skiing? But I’m also wondering about queues for lifts, the Big Ski Industrial Complex (a term I just coined) and pooling resources. When these topics converge, I must write.

The trigger?

A wage dispute between ski patrollers at Park City Mountain in Utah and its owner, Vail Resorts, disrupted operations during the peak holiday season.

The heavy snowfall that created ideal skiing conditions and brought skiers and snowboarders (which should be banned anyway) to the mountains, resulted in long lift lines, limited trail access, and growing frustration due to a strike by the patrollers.

The union, representing over 200 patrollers, initiated the strike after months of unsuccessful negotiations, demanding a modest pay increase that Vail has so far resisted. Without adequate staffing to ensure safety and conduct essential tasks such as avalanche mitigation, only a fraction of the resort’s expansive terrain is open, leaving visitors disheartened, as shown below.

The main issues?

This took place in the middle of the heavy ski season, when people are paying north of $300 for a lift ticket for a single day, only to be stuck in long lines with a limited ability to ski.

In the U.S., skiing has evolved from a recreational pursuit to a marker of social and financial privilege, driven largely by the consolidation of ski resorts under a few powerful corporations. Unlike the European model, where decentralized ownership fosters competition and accessibility, U.S. resorts have embraced pricing strategies that prioritize profitability over inclusivity.

Take the Alps, for instance, where skiing remains accessible to a broader demographic, with affordable lift tickets and minimal entry barriers. As a family, after skiing for years in Colorado (Beaver Creek) and Utah (Deer Valley), we moved to the French Alps. While this may sound snobbish, it’s actually more sensible. For example, this winter, lift tickets were 59 Euro per day even during the holiday season. Ski instructors are cheaper. Food is cheaper (and much better), and accommodation is more affordable. The flight fare is comparable, and from New York, it takes about the same time to get to the French Alps as it does to Beaver Creek or Vail.

Today’s article explores the financial, operational, and strategic dimensions of modern ski lift pricing, using Vail Resorts as a central case study. By unpacking Vail’s financial performance, I seek to understand the broader implications of its pricing strategies, particularly the introduction of the Epic Pass and its effect on demand, revenue stability, and customer experience.

And ponder on how the joy of skiing can remain an experience that transcends economic barriers.

Analysis of Barro and Romer’s “Ski-Lift Pricing”

At the core of the debate lies the fact that Vail charges exorbitant prices, while providing low quality service because of their unwillingness to pay key employees.

If you think about it, the core issue is that you’re paying for a lift ticket regardless of how much of that lift you’ll get to use.

This may sound trivial to some, but it’s not.

I was surprised to find a paper by a Nobel Laureate on the topic: “Ski-Lift Pricing, with Applications to Labor and Other Markets” by Robert J. Barro and Paul M. Romer. Published in 1987, the paper examines the pricing mechanisms used in ski-lift operations and similar contexts, such as amusement parks. The authors aim to understand why ski resorts set prices that result in queues, particularly during peak demand times, instead of raising prices to clear the market.

Motivated by the need to address the apparent inefficiency of chronic queuing, which traditional economic thought suggests leads to poor allocation of resources and suboptimal investment decisions, the authors argue that such pricing methods may, under certain conditions, be both rational and efficient.

To analyze this, the authors use a theoretical model to compare two pricing strategies: per-ride pricing and lift-ticket pricing (a fixed entry fee allowing unlimited rides). They assume that ski areas aim to maximize profits while dealing with a downward-sloping demand curve. The method includes an examination of the “package-deal effect” (bundling rides into a single lift-ticket price) and the “homogeneity effect” (conditions where congestion has no efficiency losses).

Their results indicate that lift-ticket pricing can achieve outcomes comparable to per-ride pricing in terms of efficiency.

In equilibrium, even if lift-ticket prices remain unchanged during peak demand periods, the effective price per ride (based on longer queues) adjusts automatically. This leads to efficient allocation despite the presence of queues. Moreover, the paper shows that such pricing minimizes the costs associated with monitoring and enforcing ride-specific prices, particularly in the face of uncertain demand.

The implications for ski-lift pricing are significant. The authors suggest that fixed lift-ticket prices, coupled with longer queues during high demand periods, may not only be optimal but also efficient.

I’d love to ask each person in the photo how efficient it was to wait in line…

An important clarification: The notion of efficiency in economics refers to allocative efficiency, where resources are distributed in a way that maximizes total social welfare—a situation where it’s impossible for anyone to be better off without someone else becoming worse off. In the ski-lift context, fixed pricing combined with queuing creates a natural sorting mechanism where people self-select based on their relative valuations of time versus money. Those who value their time more highly might shift to off-peak periods, while those who value money more might be willing to wait in line. The queuing system thus acts as a non-monetary pricing mechanism that efficiently allocates lift access without the potential negative perceptions associated with surge pricing, as it allows skiers to choose whether to “pay” with their time or adjust their skiing schedule.

I understand this doesn’t address the specific issues of holiday skiing while the ski patrol is on a partial strike, but it explains why ski resorts stick with the current pricing scheme. Furthermore, the sorting mechanism the authors are talking about isn’t that simple when people schedule their vacation in advance.

Europe, Where the Free (Ski) Market Reigns

As I mentioned, my family now enjoys skiing in the French Alps, so when I ran into the paper “Lift Ticket Prices and Quality in French Ski Resorts: Insights from a Non-Parametric Analysis,” I got curious. Authored by François-Charles Wolff, the paper investigates the relationship between lift ticket prices and the quality attributes of ski resorts in France. The study seeks to understand whether the pricing of lift tickets reflects the quality offered by the resorts, and identifies which resorts provide the best value for a given level of quality.

The motivation behind this research lies in the ski industry’s significance in France and the wide disparity in lift ticket prices across different resorts. Understanding the price-quality relationship is crucial for both skiers seeking the best value and ski resorts aiming to set competitive prices while maintaining efficiency.

The main research question centers on how lift ticket prices correspond to quality attributes and whether some ski resorts are more efficient in their pricing, offering the lowest possible price for a given quality.

The data used in the study comes from a unique dataset of 168 French ski resorts during the 2010–2011 season, collected from a Ski Info website. This dataset includes detailed attributes such as the number of lifts, the length and number of slopes, and the altitude of each resort, alongside the lift ticket prices.

The methodology involves two main steps: First, a synthetic quality index for each resort is constructed using Principal Component Analysis (PCA). This index captures the key quality attributes of the resorts in a single metric. Second, a non-parametric model is applied to identify the efficient resorts in the price-quality space. Efficiency is defined as offering the lowest price for a given quality level.

The results reveal significant regional differences in pricing efficiency. Resorts in the Pyrenees and Southern Alps exhibit low inefficiency, with average inefficiencies of less than 1.5 euros per ticket. In contrast, resorts in the Northern Alps are less efficient, with an average inefficiency of nearly 4.8 euros. The inefficiency is attributed to the availability of large, connected ski areas in the Northern Alps, which offer significantly more runs for a small surcharge.

This is how the efficient frontier looks:

The study’s results suggest that skiers can save money by choosing resorts on the efficient frontier, particularly in large, connected ski areas.

But the main message is clear: In France, there is real competition among differentiated ski areas. Within these areas, there is competition among ski schools, accommodations, and restaurants. It feels very competitive, very capitalist,...very American… Unless by American you mean quasi-monopolist.

The Economics of Epic Passes

At the heart of the transformation of the ski industry in the U.S. lies Vail’s Epic Pass, a product that reshaped the economics of skiing in America. Introduced as a solution to mitigate revenue volatility due to unpredictable snowfall, the Epic Pass offers skiers unlimited access to Vail’s network of resorts for a fixed price.

Much of Vail’s $1.44 billion lift ticket revenue for 2024 can be attributed to the Epic Pass, which exemplifies a modern paradox—promising affordability while enabling pricing power. On one hand, it provides financial predictability by locking in revenue before the season starts. On the other, it creates a surge of demand during peak periods, straining resources and diminishing the on-mountain experience.

This tension is not merely anecdotal. When snow conditions align with school breaks and work holidays, resorts become overwhelmed. Lift lines grow exponentially, and skiers find themselves trading precious hours of slope time for long waits. The dynamic underscores the limits of static pricing models in managing peak demand, raising important questions about how the industry balances access with quality.

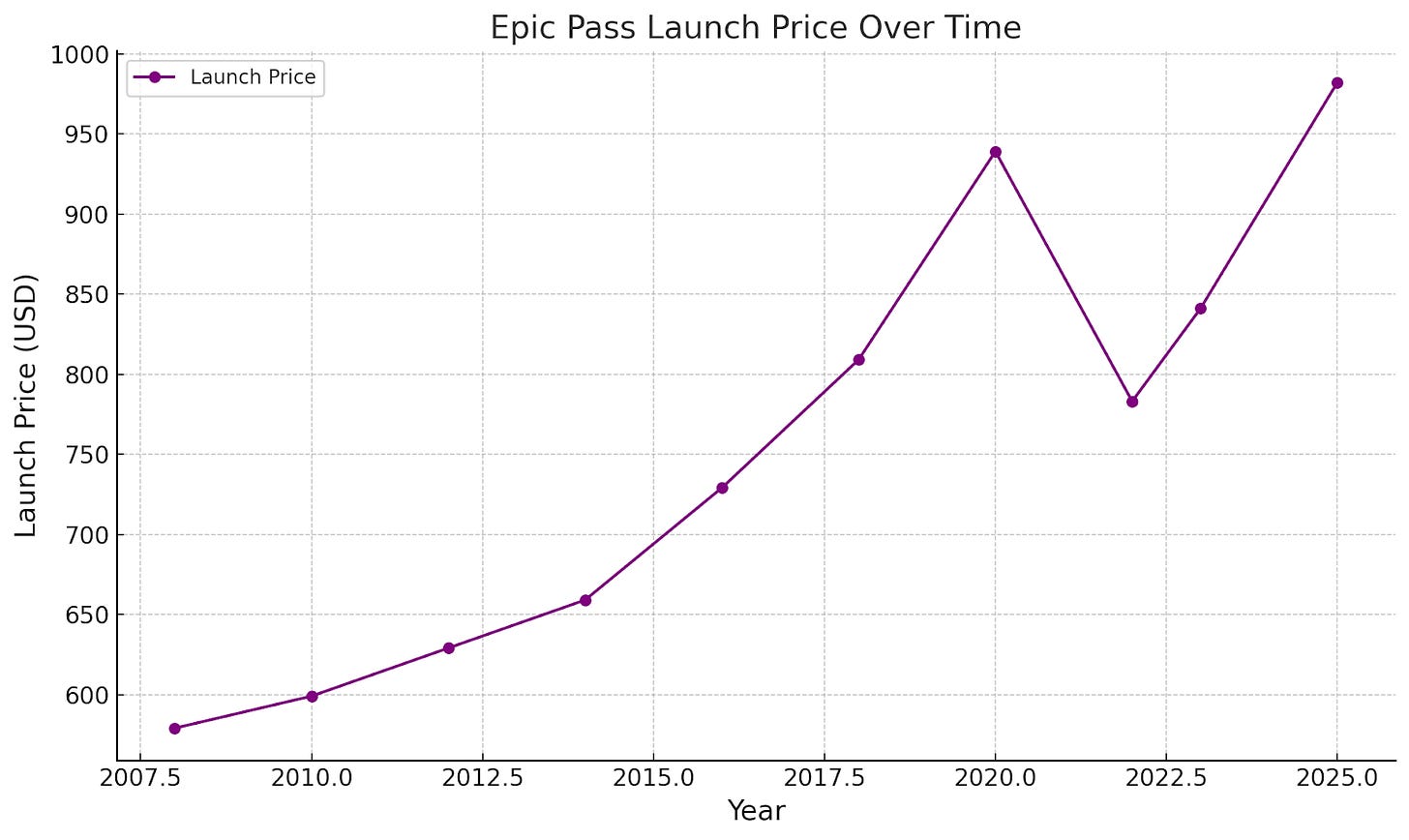

Let’s take a closer look at how the Epic Pass has evolved.

The Epic Pass was introduced in 2008 as a strategic response to critical challenges faced by the ski industry, particularly for Mountain Resorts (MTN). Key trends in snowfall variability, rising operational costs, and shifting skier preferences prompted the need for a disruptive pricing and marketing approach. The Epic Pass addressed these challenges by offering affordability, predictability, and increased accessibility for skiers while simultaneously boosting MTN’s market share and revenue stability.

The ski industry is highly sensitive to weather conditions, as illustrated by the following graph. Significant drops in snowfall during key years led to reduced skier visits and increased revenue volatility. This made MTN’s traditional business model, reliant on short-term ticket sales, particularly vulnerable to adverse weather conditions. By introducing the Epic Pass, MTN shifted its revenue model to focus on upfront, prepaid season pass sales, mitigating the financial risks associated with poor snow seasons.

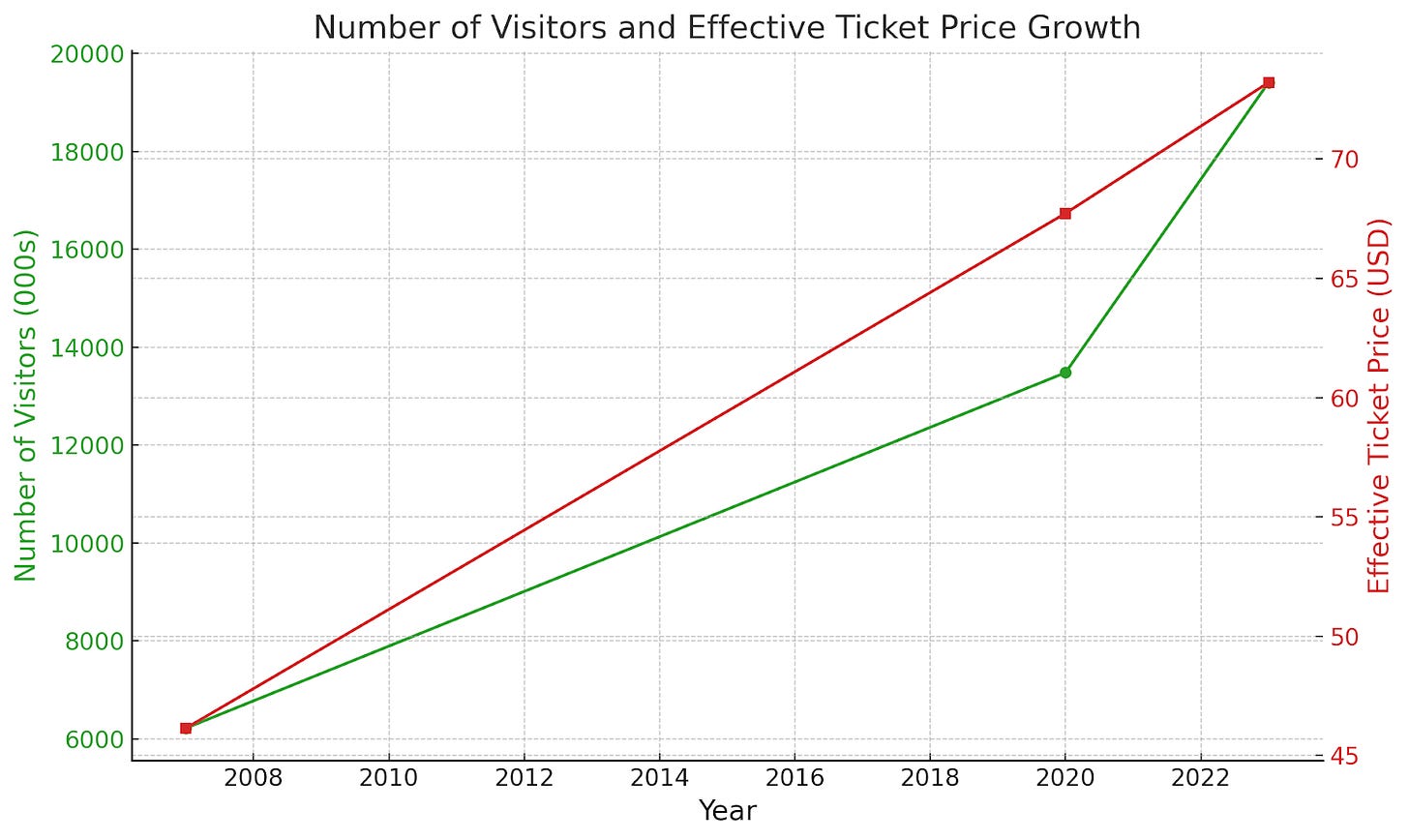

From 2008 to 2023, the number of Epic Pass members surged from 60,000 to 2.4 million, accompanied by a dramatic increase in MTN’s U.S. market share from 11% to 30%. The Epic Pass offered skiers “value” by providing access to a wide network of resorts at a fixed price, encouraging loyalty and repeat visits. This strategy created a virtuous cycle: more passholders increased visitation, which justified further expansion and enhanced the pass’s value.

The introduction of the Epic Pass aligned with the growing demand for skiing, as evident from the increase in visitors from 6.2 million in 2007 to 19.4 million in 2023. Offering deep discounts compared to daily lift tickets, the Epic Pass allowed MTN to increase its effective ticket price from $46.15 to $73.20 over the same period (which is the actual price per day paid by skiers), even though the price of the pass itself increased significantly over that time (see the graph above). This combination of higher visitation and strategic pricing allowed MTN to capture greater revenue while maintaining its competitive edge.

Between 2007 and 2023, MTN’s cost per employee rose from $12,000 to $18,000, driven by tight labor markets and higher living expenses in ski towns. By securing predictable revenue through season passes, MTN could offset these rising costs while maintaining the seasonal workforce necessary to operate its resorts efficiently.

However, what makes the issue more complex is the disparity in skier visits between the Northeast and the Rockies. From 1980 to 2022, skier visits in the Rockies consistently outpaced those in the Northeast, reflecting better snow conditions and larger resort capacities. The Epic Pass capitalized on this regional preference by bundling access to premier Western resorts, thus attracting skiers who sought better value and experience.

But during the holiday season, when skiers from the Northeast and the Rockies all try to ski on their Epic passes, revenues are very predictable, and so is demand.

But you know what else is very predictable?

Queues...

When Pooling Doesn’t Work

Vail has another important feature together with the Epic Pass. It pools together multiple resorts under the same pass and the same management.

Pooling is a widely used operational strategy to manage variability and balance demand across resources. In theory, pooling increases efficiency by sharing capacity among multiple users, thereby reducing the risk of bottlenecks. However, in certain contexts, such as Vail’s ski resort operations, pooling can break down under specific conditions, leading to unintended consequences and customer dissatisfaction.

The introduction of the Epic Pass was intended to promote pooling by granting skiers access to a wide network of resorts, including Vail, thereby spreading demand across multiple locations. However, Vail’s experience highlights the limits of this strategy when the system encounters capacity constraints and operational inefficiencies.

Capacity Constraints and Crowding: A key challenge at Vail was its limited lift and slope capacity during peak times. The popularity of the Epic Pass significantly increased the number of visitors, particularly on weekends and holidays, overwhelming the resort’s infrastructure. The result was long lift lines and overcrowded slopes, which undermined customer experience. Vail’s so-called “lift line apocalypse” became notorious, with viral images showing massive waiting crowds, turning what should have been a day of leisure into an exercise in frustration.

Pooling failed to deliver its intended benefits because Vail lacked the capacity to absorb the additional demand efficiently. Instead of reducing variability, the system amplified the peak-period congestion, creating operational bottlenecks that degraded service quality.

Regional Differences in Demand Patterns: Another factor that disrupted pooling was the uneven distribution of skier preferences. While the Epic Pass encouraged skiers to visit multiple resorts, many customers gravitated toward high-profile destinations like Vail due to its reputation, snow conditions, and terrain. This concentrated demand at Vail while other resorts in the network remained underutilized. Rather than smoothing demand across locations, pooling exacerbated the imbalance, creating a lopsided operational load.

Customer Expectations: For many skiers, Vail represents a premium resort experience. When pooling brought more visitors to the resort, it diluted the exclusivity and quality that skiers expected. Long lines, crowded slopes, and reduced time on the snow conflicted with the premium brand image Vail had cultivated. Customer dissatisfaction quickly spread, revealing how operational misalignments can damage a resort’s reputation and reduce long-term loyalty.

Vail’s experience clearly demonstrates that pooling is not a one-size-fits-all solution and there is much to consider before moving in that direction.

Financial Analysis of Vail Resorts

But it’s important to remember that one of the main reasons for the long ski lines is the ski patrol strike because Vail was unwilling to increase wages for these employees by $2 per hour.

To understand this decision, we must first understand the firm’s financial situation.

Vail Resorts’ financial performance in the fiscal year 2024 offers critical insights into the economic dynamics of the ski industry. Despite a challenging season marked by a 9.5% decline in skier visits, Vail recorded $2.89 billion in net revenue, down only 0.1% from FY 2023. Lift ticket revenue alone contributed $1.44 billion, a 1.5% increase from the previous year, demonstrating the company’s ability to leverage pricing power through its Epic Pass program.

However, the season also exposed vulnerabilities. Retail and rental revenue dropped significantly, declining by 12.3% to $312 million. This decrease, likely driven by fewer skier visits, underscores the sensitivity of ancillary revenue streams to on-mountain traffic. Lodging revenue also dipped by 1.3%, totaling $336 million, while dining and ski school revenues increased modestly by 1.3% and 6%, respectively, highlighting shifts in guest spending behavior.

As you can see above, net income remains fairly flat even as revenues increased demonstrating lack of scalability, and indeed lack of pooling benefits.

The company’s Effective Ticket Price (ETP) surged to $82.14, reflecting a 12.2% increase from FY 2023. This rise in ETP mitigated the revenue impact of reduced visitation but also points to potential limits in pricing elasticity, particularly as the Epic Pass market matures. Additionally, Vail’s reliance on Midwest resorts, which experienced a 26.7% drop in skier visits due to poor snow conditions, highlights geographic risks that could impact future performance.

From a cost perspective, labor remains the largest expense, accounting for 42% of mountain operating costs. Efforts to manage these expenses through workforce reductions and operational efficiencies are evident in the company’s “Resource Efficiency Transformational Plan,” which includes a 14% reduction in corporate staff. While these measures aim to stabilize profitability, they may also impact service quality and long-term brand equity.

Overall, Vail Resorts’ FY 2024 financials reflect a company navigating the delicate balance between growth, cost management, and customer experience. The continued success of its pricing strategies, including the Epic Pass, will be pivotal in sustaining its market leadership while addressing operational and environmental challenges.

The challenges facing Vail and its peers reflect broader issues in service-based economies. Much like urban congestion pricing, ski lift pricing should ideally regulate demand and optimize resource allocation. Yet, as Vail’s Effective Ticket Price (ETP) increases to $82.14 despite a 9.5% drop in skier visits, it becomes evident that current strategies fail to achieve this balance. Unlike the European model, where decentralization fosters natural price differentiation, the U.S. approach centralizes control, compounding inefficiencies.

Bottom Line

All this even before discussing climate change and the fact that many resorts may not exist 20-30 years from now, and that with the current U.S. prices it’s possible that younger generations will ski even less.

The future of skiing depends on the industry’s ability to balance accessibility with financial sustainability, ensuring that the joy of carving through fresh powder isn’t relegated to the privileged few, but remains a shared experience that bridges economic divides and generations to come.

This requires addressing the operational inefficiencies exposed by Vail’s reliance on static pricing and pooled resources, while also reconsidering labor practices, such as ensuring fair wages for critical staff like ski patrollers, to maintain service quality and customer satisfaction during peak periods.

After all, if I wanted to wait in line for hours and overpay for disappointment, I’d just go to Disneyland.

You don’t mention a key component of competition: new entrants to the market. The last new ski resort opened in 1980. The permitting and capital expenses means we can’t build new resorts to soak up additional capacity.

Great read. Think I’ll stick to Japan. Conditions are generally amazing. Exchange rate is favourable. Lift passes around $60 per day. Never had to queue, even in peak season. ….Japanese food!