Stocking Out Like It’s March 2020 All Over Again

One of the main storylines in the early days of the COVID outbreak was the shortage of certain essential products. Who can forget the empty shelves of toilet paper? Fortunately, most supermarkets overcame those shortages and the attention shifted to shortages of other items around the world, from kettlebells to toys and cars.

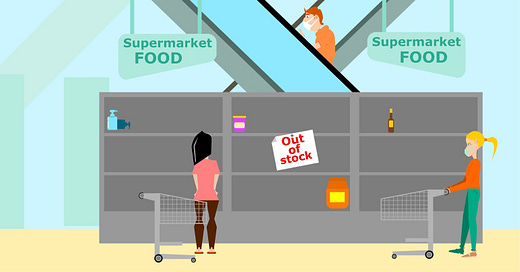

But if you visited your local supermarket recently, you may have noticed that shortages are back. In fact, they are as acute as they were at the beginning of the pandemic…or maybe even worse.

It is common for supermarkets to occasionally run out of products, but the fact that these shortages are essentially a global phenomenon that impacts almost every product, is surprising.

The Extent of Shortages

An interesting question is whether these are just anecdotal observations amplified by the media or for real.

Well, unfortunately, they’re real.

Based on various articles from this week, including USA TODAY, grocery stores in the US usually experience a shortage of around 5-10% of their items at any given time. According to Consumer Brands Association President and CEO Geoff Freeman, however, right now, the stockout rate is closer to 15% and, on some occasions, even reaches almost 30%.

It’s also important to note that these shortages are not only witnessed in the US.

Here is a photo from Australia:

And Canada:

According to USA TODAY, consumers are indeed worried.

“In a recent study by business consultancy KPMG, 71% of grocery consumers said they were somewhat or very concerned about shortages or stockouts with 35% switching brands when their favorite items are out of stock.”

The Causes

Just like everything we have experienced since the beginning of the pandemic, I don’t think these shortages stem from a single source.

There doesn’t seem to be a general food shortage. The shortages we see are usually of a specific brand or a specific type of food.

One of the main hallmarks of the pandemic is the impact on supply chains and the fact that we see both demand shocks and supply shocks.

Let’s take a look at the supply side:

Some say that it’s not a production issue, but a supply chain issue:

“‘We don’t have a problem with farms producing enough food. We have problems with not enough labor in the supply chains between the farms and the consumers,’ said Paul Lightfoot, president and founder of BrightFarms, a company that grows leafy greens hydroponically at five indoor farms in the Midwest and on the East Coast.”

But in some cases, there are production issues. In Canada, Michael Graydon, CEO of Food, Health & Consumer Products, mentions that manufacturers are compelled to decrease production as absenteeism reaches up to 20% in some factories.

“‘You end up having to cut significant manufacturing capacity because you don't have the labour,’ he [Graydon] said. ‘We already have high demand for products because the restaurant industry is virtually down and out and home consumption increased.’”

It also seems that the principal cause, looking at this from the supply side, is the ongoing labor shortage.

This impacts almost every step of the supply chain. Especially in the food industry, the labor shortage seems to mainly impact the processing stage.

“According to a new analysis out of Purdue University, among various food manufacturing industries, ‘animal slaughtering and processing’ is most likely to be significantly impacted by disruptions in labor. Because so many individuals are needed to take an animal from slaughter to packaged meat, ‘If something happens, it actually leads to a much larger loss in production compared to any other food industry on that list,’ said Ahmad Zia Wahdat, a researcher who worked on the data and paper with Jayson Lusk, the head of agricultural economics at Purdue.”

It’s hard to recruit workers in almost any industry these days, but the situation in many of these processing plants is even worse given how contagious the Omicron variant is and how these food processing plants have been, from the beginning, the source of many superspreading events.

Adding to this the lack of workers needed to restock shelves, it’s easy to see how stockouts in supermarkets are not much different from what we have experienced in any other industry so far. It’s just that the food supply chain is so complex, with its many steps and low inventory (due to perishability), that even the slightest disruption creates a shock of multiple magnitude.

But there are also stockouts that are unique and unrelated to the labor shortage. Like the recent shortage in cream cheese.

Besides what we have already mentioned and anything we could possibly think of, cyberattacks on food production is another factor that has exacerbated the issue. In October, the largest US cheese manufacturer suffered a cyberattack which led to a shortage in cream cheese across the nation. If there’s no cheese, there’s no cream cheese.

But since not everything is related to the supply side, let’s take a look at the demand side.

Over the last two years, as more people started baking at home during the stay-at-home orders, demand for cream cheese shot up 18% compared to 2019.

In general, Americans have started eating at home more than they used to, especially since many continue to work from home and there are a number of school closures due to positive cases. Food consumption has increased and with so many random school closures and openings, it’s hard to predict where the next demand spike will be.

Another surprising demand-driven shortage: pet food.

Since the beginning of the pandemic, several households in the US acquired pets.

“Finally, it’s important to note that many more people are spending additional time at home with their pets. This can lead to increased feeding and more treating than usual, as pet owners look for more ways to bond with their pet.”

We go out less, we spend more time at home, we cook, we eat, and we feed our animals more. I don’t see how this can end badly.

Again, none of this is new, but the combination just makes it hard to resolve the compounding effect of these small shocks.

Are There any Solutions?

Rationing

The first (and worst) solution is to limit purchases of select items, similar to policies implemented at the start of the pandemic. According to Costco's website, some warehouses may have temporary item limits on select items.

As I have explained before, this is not a viable solution since it just prompts customers to hoard more, inflating demand even further and creating even more shortages.

Shifting to Substitutes

Since there is no real food shortage, and only a temporary disruption in supply, redirecting demand to other similar products is a good solution.

For example, Kraft, which owns Philadelphia Cream Cheese, announced that it would reimburse some customers who bought a different dessert because they couldn’t find cream cheese in time to make holiday cheesecake.

In Australia, Woolworth, one of the main supermarket chains, sent an email to customers suggesting the same:

“We also have good supply within each ‘category’ of product (even if your favourite isn't available, a good alternative hopefully should be), so it really helps if you can be flexible with the choices you make,”

The risk, of course, is potentially losing a customer to a different brand or a different chain.

Producing Locally

Just like anything in supply chains these days, firms have to decide whether to move closer to home:

“Brunnquell [president/owner of Egg Innovations] is also shifting the company toward sourcing more domestically to avoid future global shipping delays. In 2021, about half of the organic soybean meal Egg Innovations’ farmers fed to chickens came from India; this year, all of it will come from American farmers.”

But as we might expect, this will impact the production cost. Did anyone here say inflation?

Carrying Excess Inventory

And finally, another solution is to start carrying more inventory. Many chains are talking about carrying precautionary stock.

Precautionary stock is just another name for safety stock. After years of Just-In-Time supply chains, firms are thinking about carrying more inventory, centrally, to deal with such shortages.

But this is not easy for many of the items carried by supermarkets. And given their perishability, definitely not for meat, fresh produce, dairy, etc.

The ultimate impact of all this (beyond shifting demand), is the increase in prices.

Where Does this End?

I don’t think any of these issues are long-lasting, but the fact that there are many minor causes, may make them more long-term than we would like.

But it does seem like part of a broader trend: we need to prepare for more volatile supply chains, where disruptions may come from labor, climate, demand shocks, or even cyberattacks.

Over the last 20 years supply chain managers and academics have improved methods (even if not always implemented) for managing and hedging against different uncertainties. But in every case, we have been hedging against known uncertainties.

I’m not sure how ready we are to manage supply chains where the source of the next disruption is unknown. Where the unknowns remain unknown until it’s already too late, and where many of these unknowns are interlinked or intertwined.

If the Just-in-Time supply chain of the last 20 years is Just-Not-Working anymore, it may be time to look into a new direction, and maybe consider flexibility as our new quest.