Ozempic, a product of Novo Nordisk, is at the center of an unfolding medical and supply chain conundrum. Originally developed as a treatment for type 2 diabetes, Ozempic leverages the power of semaglutide to regulate insulin production, thus controlling blood sugar levels.

However, as you may have read, its rising popularity is not solely due to its efficacy in managing diabetes. An unintended yet significant application of Ozempic lies in its ability to induce weight loss and suppress appetite, attributes attributed to the semaglutide component, which is also a key ingredient in Novo’s anti-obesity medicine, Wegovy.

Despite not being officially sanctioned for obesity treatment, demand for Ozempic has skyrocketed, primarily fueled by those seeking its weight loss benefits.

Some of you might be wondering, since when this newsletter has taken an interest in health care. Well, since health care met supply chain and operations: The surging demand for Ozempic has precipitated a supply chain strain, compelling Novo Nordisk to ration its distribution in Europe.

Rationing Strategy: Balancing Medicine Allocation

What makes the situation “interesting” is that the decision to ration distribution also affects the supply of Victoza, another diabetes medication, as resources are diverted to boost Ozempic’s production.

In fact, Novo went a step further and wrote:

“No new patients should be started on Victoza until at least Q2 2024 when supply is expected to normalise…”

The rationing of Ozempic and Victoza presents a multifaceted dilemma, involving several layers:

Ozempic vs. Victoza: Ozempic and Victoza, both GLP-1 receptor agonists, serve different patient populations despite their similar class. However, Ozempic’s appeal for weight loss has overshadowed its primary role as a diabetes treatment. The question is whether the firm should prioritize medicine that can save lives or medicine that can also be used by non-patients as a lifestyle choice (i.e., for weight loss). Novo Nordisk didn’t become the largest healthcare company in Europe solely due to the use of its medicine by diabetic patients.

New vs. Existing Patients: Novo Nordisk’s strategy includes prioritizing existing patients over new ones, especially for the 0.25-mg starting dose of Ozempic. This approach aims to ensure continuity of care for current patients while managing the influx of new requests. Purely from a business point of view, both Customer Acquisition and Retention are considered important metrics, but which one is more important? Also, the world in which these metrics are most valuable is one where the bottleneck is on the demand side. And while we haven’t reached that point just yet, it’s important to note that Eli Lilly will be launching their new anti-obesity medicine soon.

Diabetes vs. Obesity Treatment: Another aspect of rationing involves distinguishing between those who use the medicine for its approved use (i.e., treating diabetes) and those who will use it for weight loss. This ethical dimension adds complexity to the allocation decision-making process.

“Several countries including Britain, Belgium and Germany have temporarily banned or strongly discouraged its use for weight loss to secure availability for diabetics but enforcement has proven difficult.”

Before we revisit what the “right ration” for Novo is, let’s try to better understand the notion of supply chain rationing and the unique aspects of this notion for medical treatments.

The Rationing Imperative: Supply Chain Constraints and Models

Capacity rationing, a response to mismatches between supply and demand, is a complex challenge and has been studied through various models in Operations Research.

These models typically assess factors like production capacity, demand forecasts, and the impact of rationing on consumer behavior. A few examples of industries that have had to use rationing are:

Automotive Industry: The paper Capacity Allocation Using Past Sales: When to Turn-and-Earn by my current colleague Gerard Cachon and former colleague Marty Lariviere, studies capacity rationing and heavily references the automobile industry, where capacity allocation is a critical issue. Examples include the GMC Suburban, where General Motors was unable to meet the high demand despite multiple capacity expansions, leading to long wait times. Other examples cited include the BMW Z3 and Harley-Davidson motorcycles, which faced similar high-demand and supply shortage issues.

The paper also discusses significant supply chain disruptions, leading to the rationing of popular models like the Toyota Prius. This hybrid vehicle’s high demand when first introduced, coupled with limited production capacity and supply chain issues (such as shortages of crucial components or raw materials), forced Toyota to allocate its inventory strategically. The decision to ration involves assessing current demand but also forecasting future trends and consumer preferences. However, such rationing can lead to customer dissatisfaction and potential loss of market share to competitors who might be better equipped to meet the demand.

Semiconductor Industry (COVID-19 Induced Challenges): As we’ve previously discussed, the semiconductor industry experienced significant disruptions during the COVID-19 pandemic when the sudden spike in demand for electronics, driven by remote work and entertainment needs, clashed with production slowdowns due to lockdowns and workforce restrictions. Firms had to ration their chip supplies, prioritizing certain customers or product lines. This rationing impacted the electronics sector but also had a cascading effect on other industries reliant on microchips, like automotive and home appliances. The challenge was to balance the immediate needs against long-term customer relationships and market positioning.

Pharmaceuticals and Healthcare: The COVID-19 pandemic also highlighted capacity rationing in the pharmaceutical industry, particularly for vaccines and other critical medicine. Limited production capabilities, coupled with unprecedented global demand, necessitated allocation strategies. Similarly, medical equipment like ventilators and personal protective equipment (PPE) also faced rationing during the pandemic peak.

Decisions involving capacity rationing are also fraught with difficulties for several other reasons, such as:

Demand Forecasting and Allocation: Accurately predicting demand and allocating inventory accordingly is daunting, especially under uncertain market conditions. On the supply side, companies usually deal with uncertain or unpredictable supply, but demand forecasting becomes even more difficult when everyone is inflating their requests to get a higher allocation.

Customer Satisfaction: Rationing can lead to customer dissatisfaction and erosion of brand loyalty, especially if consumers perceive the process as unfair or poorly managed.

Bullwhip Effect: As highlighted by Cachon and Lariviere, inventory rationing can exacerbate the bullwhip effect, where small fluctuations in demand at the retail level cause progressively larger oscillations in demand at the wholesale, distributor, and manufacturer levels. This phenomenon complicates inventory management and can lead to inefficiencies and increased costs.

Nevertheless, firms can implement a variety of strategies to address the challenges of capacity rationing.

First, transparent communication is crucial; firms can effectively manage expectations by keeping stakeholders informed about supply constraints and rationing decisions. Secondly, diversifying supply chains by engaging multiple suppliers or using alternative materials can help reduce the dependence on a single source, thereby enhancing resilience. Demand management is another key strategy, where firms can use pricing strategies or promotions to smooth out peak and demand troughs, leading to more efficient inventory management. Finally, integrating technology, particularly advanced forecasting tools and analytics, can significantly improve the accuracy of demand predictions and optimize inventory allocation, helping firms navigate the complexities of capacity rationing.

Best Practices Prioritizing Patients: Insights from Dynamic Resource Allocation Models

It’s one thing to ration a car and an entirely different thing when dealing with medical treatments.

Novo Nordisk’s decision to ration Ozempic starter kits due to soaring demand and supply constraints raises critical questions about how to allocate these resources efficiently and ethically.

This issue echoes healthcare providers’ challenges in resource-limited settings, particularly in allocating scarce treatments that require long-term sequential treatments.

The research paper Dynamic Allocation of Scarce Resources Under Supply Uncertainty by Sarang Deo (another former colleague) and Charles Corbett explores the dynamic allocation of scarce resources, particularly in the context of HIV clinics, and offers some insights into this issue. While it looks at a very different (and more severe) health risk, the study is similar to Ozempic’s case in the sense that both aim to balance the trade-off between treating new and existing patients under supply uncertainty.

When considering health care operations, the question is, “What’s the correct objective?”

The study’s objective was to maximize patients’ total expected quality-adjusted life years (QALYs) over a planning horizon. This approach is highly relevant to the Ozempic situation, where the goal would be to optimize the health outcomes of diabetic patients amidst supply constraints.

At the heart of the resource allocation problem is the trade-off between two key objectives:

Providing access to treatment for new patients: This represents the expansion of treatment to those not currently receiving it.

Ensuring continuity of treatment for current patients: Continuity is critical, especially for chronic conditions like diabetes, where consistent treatment is vital for effective disease management.

The study’s main result is the establishment of conditions under which it’s optimal to prioritize the treatment of current patients over new ones. This finding is aligned with clinical guidelines that emphasize uninterrupted treatment for existing patients. However, given the variability and uncertainty in supply chains and patient demand, these conditions are not always straightforward to apply in practice.

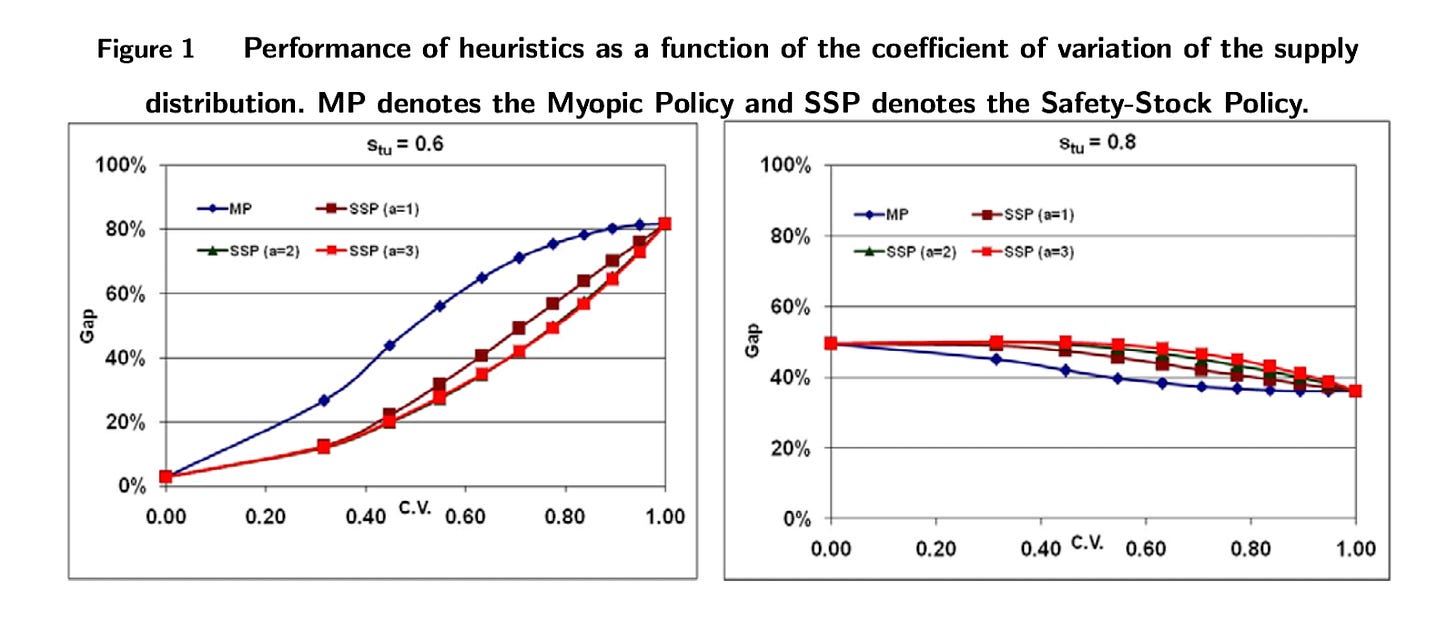

Let’s use a figure from te study to understand. The figure depicts the gap in % between the optimal allocation strategy between new and existing patients (which can be quite complex) and strategies (Myopic and Safety-Stock) that are easy to implement. The Myopic strategy allocates capacity to whoever comes next, whereas the Safety Stock keeps some units for existing users to ensure uninterrupted supply. The graphs consider different levels of Stu, which denotes the Quality-of-Life score for previously treated patients whose treatment is interrupted in the current period.

Let’s interpret what we see: Firstly, the impact of the performance gap varies based on whether the value of Stu is high or low. When Stu is low (indicating a significant penalty for halting treatment), the effectiveness of various heuristic approaches compared to the optimal policy decreases as supply uncertainty grows. This means that in scenarios where avoiding treatment interruptions is crucial, the importance of employing the optimal policy intensifies with greater supply uncertainty. Additionally, maintaining a higher safety stock tends to yield improved outcomes under these conditions.

Conversely, when Stu is high (suggesting a lower penalty for treatment interruption), a myopic policy tends to outperform the safety stock strategy, as avoiding interruptions is less critical. In such cases, a larger safety stock leads to poorer outcomes, meaning a wider performance gap.

However, it’s important to recognize that a myopic policy isn’t always the best choice when Stu values are high. An alternative, more effective strategy might involve delaying patient enrollment initially, accumulating stock, and then expanding the patient pool in later periods. This approach can lead to higher overall enrollment than the myopic policy, particularly in contexts with low penalties for treatment interruption.

The Implications for Ozempic

Based on the insights from the paper and Ozempic’s specific characteristics, an optimal policy for Novo Nordisk should consider the following aspects:

Prioritize Existing Patients with Type 2 Diabetes: Given the significant health risks associated with interrupting Ozempic treatment, such as the potential rebound of blood sugar levels and deterioration of diabetes control, existing patients should be prioritized. This aligns with the paper’s findings, where continuity of service is crucial, and the penalty for treatment interruption is high.

Manage New Patient Enrollments with Caution: New patients, particularly those seeking Ozempic for weight loss (a non-FDA-approved use), should be enrolled cautiously. This is due to the uncertain and variable supply of Ozempic and the need to prioritize those with clinical needs for diabetes management.

Since stopping Ozempic leads to increased appetite, weight gain, and potential worsening of diabetes, these factors should be heavily weighted in the decision to initiate new patients on the treatment, especially given the supply uncertainty. In fact, that means that Stu is low, which means that the safety stock policy will do well, keeping inventory for existing users rather than new users.

Furthermore, Novo Nordisk should have a clear, transparent policy that outlines the criteria for patient prioritization. This should be communicated effectively to healthcare providers and patients to manage expectations and ensure ethical distribution. The allocation strategy must consider the broader public health impact, ensuring that those who need Ozempic for diabetes management are prioritized over those who will use it for weight loss.

Future Outlook: Investment in Production Capacity

In response to these challenges, Novo Nordisk has committed $6 billion to expand production facilities in Denmark. This investment is crucial to meeting global demand for weight-loss medication and resolving supply constraints. Such expansion addresses immediate supply issues and prepares the company to handle future demand surges better, whether for existing products like Ozempic and Wegovy or for upcoming treatments like Eli Lilly’s Mounjaro.

In conclusion, the Ozempic situation presents a complex interplay of medical needs, supply chain dynamics, and ethical considerations in medication rationing.

While Novo Nordisk’s response and future plans seem to be in the right direction, the scenario underscores the broader challenges the pharmaceutical industry faces in balancing supply and demand, particularly for high-demand medicine with multiple uses.

But, with Ozempic’s rationing, McDonald’s might just “reacquire” its lost customers —a twist in the tale where fast food meets pharma.

Excellent read. “Articulate and detailed”

Curious to hear how you see Ozempic and others impacting supply and demand in the cpg industry. Large cpgs are already anticipating an impact but are they overreacting?