This Week’s Focus: Tariffs, Transparency, and Corporate Honesty

Last month, reports surfaced that Amazon considered adding a visible tariff surcharge to product prices—a move swiftly shut down by the White House and Trump. While Amazon clarified the idea was never approved, it sparked broader questions: If companies want to be transparent about pricing, why isolate tariffs? Why not disclose executive pay, labor costs, or profit margins? This week’s article explores the selective nature of corporate transparency, comparing emerging tariff disclosures to models like Everlane’s “radical transparency,” and examines why firms are more comfortable revealing costs driven by external forces than those tied to internal choices.

In April 2025, reports emerged that Amazon was considering adding a visible tariff surcharge to prices on its platform—a move that immediately ignited controversy.

The White House slammed the idea as “a hostile and political act,” and following a call from President Trump to Jeff Bezos, Amazon quickly clarified that while an internal team had mulled the idea for its discount marketplace (Amazon Haul), the plan “was never approved and is not going to happen.”

The incident, however, served as a high-profile hook highlighting an emerging trend in e-commerce: openly displaying tariff costs to consumers.

But if firms are genuine about being transparent on pricing, why stop at tariffs? Why not reveal how much of the price goes toward the CEO’s compensation package?

Today’s article explores how such tariff disclosures fit into a broader debate regarding price transparency by comparing this new trend to established practices like Everlane’s “radical transparency” pricing model, and asking why companies are isolating tariffs specifically—and not labor or other costs—in their disclosures.

Let’s peel back the pricing label.

Tariff Surcharges: A New Transparency Tactic in Online Retail

Facing escalating import taxes, a number of e-commerce players have started adding explicit tariff surcharges to customer receipts or checkout pages. Rather than burying these costs in the product price, they are breaking them out as separate line items—often with pointed labeling. Notable examples include:

Temu: Temu, known for ultra-cheap goods shipped from China, began displaying U.S. tariff fees in its pricing as they hit its business. This followed the U.S. ending a de minimis rule that previously allowed small parcels from China to enter tariff-free. By itemizing tariffs, Temu can show shoppers exactly how trade policies are impacting prices.

Dame (Intimacy products): Direct-to-consumer sexual wellness brand Dame now adds a flat $5 “Trump Tariff Surcharge” to certain products. At checkout, customers see this tongue-in-cheek fee (complete with an icon of Trump-esque hair) listed separately. “It’s a little funny, it’s a little sad, but above all, we just want to be as transparent with you as possible,” the company explained on social media. Notably, Dame’s CEO admitted the $5 charge won’t fully cover the higher import costs; the goal is more to raise awareness of the tariff’s impact than to recoup every penny.

Jolie Skin Co. (Beauty hardware): Luxury shower head maker Jolie is rolling out software updates to add a “Trump Liberation Tariff” fee at checkout. This fee will explicitly show customers how much of the price is due to recent China tariffs. Jolie’s aim is to be up-front about cost increases outside its control.

Companies adopting these surcharges are essentially calling out tariffs as the reason behind higher prices.

The rationale is twofold: First, it directs customer frustration toward external factors (tariff policies) rather than the company. Second, it aligns with a growing consumer expectation for honesty on pricing. As Wired noted, firms struck by tariffs “will likely pass the hit along to consumers – and some will want to clearly point the finger at who is to blame.” By labeling a cost as a “Trump Tariff” fee, businesses make it clear that the extra charge is a tax, not an arbitrary price hike.

However, this approach is not universal. Many large retailers remain wary of tacking on separate fees at checkout. As the article noted, “For Apple, for Samsung, or anyone else trying to be a huge international consumer tech company, I think they’ll really want to avoid creating confusion for customers,” observed one tech industry analyst. Extra line items could irritate or baffle shoppers accustomed to all-inclusive pricing. Moreover, as Amazon’s experience showed, highly publicized tariff fees can invite political backlash. In Amazon’s case, merely floating the idea caused a stir: their share price dipped 2% on the initial report and only recovered after the company publicly walked back the plan.

Why Tariffs – Why Now?

There is a reason why tariffs have become the focal point for these new transparent surcharges. As discussed before, tariffs are an external, variable cost imposed by government policy—one that has spiked dramatically in the U.S.–China trade war. When a retailer highlights a tariff cost, it effectively shifts blame for price increases away from the company, and onto geopolitical forces. This is a form of transparency that serves the company’s interest: it educates customers about a cost driver largely out of the seller’s control. As such, it can preserve goodwill by saying, in essence, “our base price is still low; this extra amount is the tariff.”

But the move prompts a broader question: Why only disclose tariffs, and not other cost components like labor, materials, or profit margins? The answer lies in the delicate balance of transparency. Companies are willing to pull back the curtain on factors that justify their prices, but are far more hesitant to reveal information that might undermine their pricing power or brand image.

Tariffs are a relatively neutral cost item to expose—they are a tax, not a direct reflection of a company’s own efficiency or ethics. In fact, exposing tariff costs can be seen as somewhat adversarial to the government policy, not to the consumer.

By contrast, consider disclosing labor costs: if a fashion retailer revealed it only pays its workers a few dollars for an item it sells for $100, customers might react negatively, perceiving exploitation or an excessive markup. Disclosing profit margins or internal markups could also trigger consumer ire if the margins seem high. Indeed, research cautions that cost transparency “can be risky because it makes the business vulnerable to…consumer ire” in cases where people don’t like what they see. A company sharing full cost breakdowns might also invite supplier pushback—seeing healthy margins, suppliers could demand higher prices—or give competitors unnecessary insight into its cost structure.

In short, many firms practice selective transparency. They reveal cost information that casts them in a favorable light or builds their case to consumers, while keeping other details opaque. Tariff fees fall into the “safe to reveal” category for certain sellers: it’s a new cost that everyone knows is the result of politics, and by exposing it, companies are appealing to customers’ sense of fairness (and perhaps even subtly enlisting them to object to the tariffs). On the other hand, operational costs and margins are longstanding elements baked into prices, and revealing them might raise uncomfortable questions (“Why is your overhead so high?” or “Why am I paying a 5x markup?”).

It’s quite telling that Amazon, which considered showing tariffs, explicitly said it never planned to mention tariffs on its main site—the experiment was only under consideration for the niche Amazon Haul section targeting ultra-budget shoppers. Large marketplaces and mass retailers handle thousands of products and have complex pricing; breaking out a tariff on every item (not to mention any other cost) could make the shopping experience unwieldy.

Beyond Tariffs: The Broader Push for Price Transparency

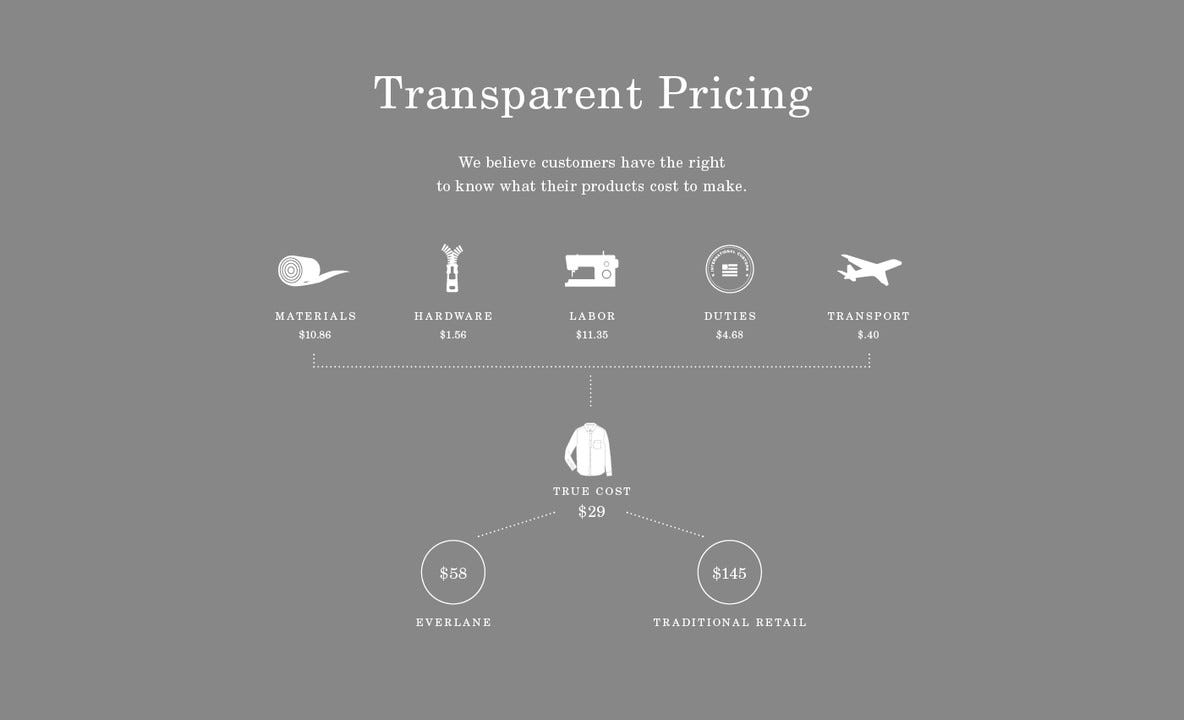

The idea of price transparency in retail isn’t entirely new. Over the past decade, a number of consumer brands have experimented with sharing detailed cost breakdowns with shoppers. The poster child is Everlane, a fashion retailer that built its brand around what it calls “Radical Transparency.” Everlane’s website discloses the true cost behind each product—including line-by-line estimates for materials, labor, transportation, duties, and even the company’s markup.

For example, an Everlane product page might feature an infographic (as shown above) breaking down the costs of fabric, labor, shipping, duties costs, and Everlane’s own margin, leading to a final price of $58, compared to $145 at a traditional retailer. By demystifying the price in this way, Everlane aims to assure customers that they are paying a fair price grounded in real costs, not an arbitrary markup. This approach has been successful in differentiating Everlane in a crowded apparel market—it fostered trust and won over a consumer base that values honesty and ethical production. Customer loyalty is a key benefit: a devoted segment of shoppers reward Everlane’s openness with repeat business, precisely because “they know exactly what they are paying for.”

Everlane is not alone. Other niche brands have embraced similar full-cost transparency models:

Honest By (a pioneering sustainable fashion label launched in 2012 by Bruno Pieters) went so far as to publish every cost and every supplier for each garment. Honest By would list where materials came from, the cost of each component, manufacturing details, and even how much each participant in the supply chain was paid—including the designer’s own cut. It prided itself on being “the world’s first 100% transparent company,” proving it was possible to share labor costs and profit margins openly. While this extreme transparency won praise for its integrity, Honest By remained a niche, boutique operation—a sign that radical openness appeals to a conscientious minority of consumers but hasn’t (yet) become mainstream.

Oliver Cabell (footwear and accessories) used to provide a cost breakdown on every product page, very much in the spirit of Everlane. Shoppers could see the price of materials, labor, transport, duties, etc., totaled up against the retail price—giving a clear view of the brand’s markup. This “complete transparency policy lets you know exactly how their product is made and what it costs,” as one press review noted. Oliver Cabell uses transparency to position its $150-$300 shoes as high value for the price, directly showing the quality inputs that justify the cost.

Interestingly, the firm no longer provides this breakdown.

Patagonia (outdoor apparel) has not broken out product pricing in dollars, but it has pioneered supply chain transparency—sharing extensive information about the factories that make its goods, the environmental footprint of products, and the fair trade premiums paid to workers. This is a different angle of transparency, focusing on ethical and operational factors rather than price composition. It demonstrates that in addition to price, “transparency” can mean many things: materials sourcing, working conditions, environmental impact, and more.

What all these examples have in common is a belief that today’s consumers are more informed and more inquisitive about where their money goes—and that meeting that curiosity with real data can build trust. Surveys bear this out: Nearly 9 in 10 consumers say transparency is important to them across industries, and 40% are willing to switch to a new brand if it offers greater product transparency. In an era of instant price comparisons and social media scrutiny, being upfront is a good way to earn credibility.

At the same time, many brands have rejected or scaled back transparency initiatives, especially in the mass market. For instance, most major electronics and apparel companies keep their cost structures closely guarded. Tech giants like Apple or Samsung, which enjoy high profit margins on devices, do not disclose their production costs or markups to the public—doing so could undermine the premium image of their products. In the retail sector, the ill-fated 2012 experiment by J.C. Penney to move to a “fair pricing” strategy (eliminating coupons and fake markdowns) can be seen as an attempt at pricing honesty that backfired. It turned out that shoppers preferred the thrill of discounts over straightforward low prices, and the company had to revert to the traditional pricing playbook.

The lesson: transparency must align with customer expectations and brand positioning. Niche direct-to-consumer brands can use it as a differentiator, but mass-market consumers may be more interested in convenience or price simplicity than granular cost details. Indeed, a large segment of shoppers might find a cost breakdown irrelevant or even confusing—they just want a good deal from a trusted brand name.

As the discussion above indicates, niche and mission-driven brands like Everlane and Honest By, are far more likely to embrace full cost transparency, including labor and overhead, while big global brands like Amazon and Apple, largely avoid exposing cost details. The newcomers adding tariff surcharges (Temu, Dame, and Jolie) are somewhere in between—they have selectively lifted the veil on one cost element (tariffs) but not others. This selective approach likely reflects a cautious dip into transparency, targeting a specific context (a sudden tariff hike) where disclosure is advantageous. It stops short of the radical openness practiced by Everlane or Honest By, whose models are still the exception in retail.

The observation from Bloomberg’s coverage of tariff surcharges sums it up: a tariff-transparency strategy “will mostly appeal to businesses with smaller product lineups and whose customers usually buy just one or two items,” versus large retailers where the risk of confusion outweighs the benefit. Likewise, full cost transparency has largely remained in the realm of niche, values-driven companies, rather than Fortune 500 firms. Transparency may indeed be more naturally suited to these niche brands at present—but the landscape is evolving.

Creating Value Through Cost and Operational Transparency

To understand the potential benefits of transparency, it helps to look at research not only on price transparency but also on operational transparency—a related concept studied by Harvard Business School professor Ryan Buell.

Operational transparency refers to making the processes and efforts behind a product or service visible to customers. Buell and Norton (2011) demonstrated that operational transparency, such as customers observing chefs preparing meals in an open kitchen, significantly enhances customers’ perceptions of value. Customers who witnessed visible effort rated the food as more delicious and perceived the service as more valuable, even though the product itself did not objectively change. The visible demonstration of effort increases appreciation and willingness to pay, primarily because customers value effort expended explicitly on their behalf.

Cost transparency, as defined and studied by Mohan, Buell, and John (2020), involves explicitly revealing the production costs behind a product or service, typically considered sensitive or confidential information. Unlike operational transparency, cost transparency affects consumer trust rather than their perception of effort. In a cafeteria field experiment, Mohan et al. found that showing the ingredient and labor costs of a bowl of chicken noodle soup increased purchase rates by 21.1% compared to when those costs weren’t displayed. Additional lab experiments consistently showed that revealing sensitive cost information enhances trust because consumers perceive this disclosure as intimate and potentially risky for the firm, thus signaling honesty and vulnerability. Crucially, this effect holds true primarily when the firm voluntarily shares this information, rather than doing so under external pressure or regulatory requirements.

Mohan et al. (2020) further explored the psychological mechanism underlying this phenomenon and through mediation analyses they demonstrated that increased trust fully explains why cost transparency has a positive impact on consumer purchase intent. This trust mechanism persisted even when controlling for alternative explanations such as perceived price fairness. Moreover, the benefit of cost transparency was robust, occurring even when product prices were lower than consumers’ initial expectations, thereby distinguishing this mechanism clearly from price fairness explanations.

Price transparency, a related but separate concept, involves clearly communicating the composition or breakdown of a product's selling price—for example, separately listing taxes, duties, or shipping fees. Unlike operational transparency (about visible processes) or cost transparency (revealing sensitive internal costs), price transparency typically affects consumer perceptions by clarifying the financial components of the purchase, thereby influencing perceptions of fairness or clarity in pricing. Mohan et al. explicitly differentiate this form of transparency from cost transparency, arguing and empirically confirming that consumers perceive cost information as significantly more sensitive and thus more influential on trust-building than mere breakdowns of selling price components.

Industry reports support these academic findings. According to a Label Insight survey, 94% of consumers are more loyal to brands practicing complete transparency, and 73% say they would pay more for products with fully transparent attributes. Similarly, the Edelman Trust Barometer (2021) highlights that 86% of consumers consider transparency from businesses crucial for building trust.

Another survey (Edelman Trust Barometer, 2021) found 86% of people believe transparency from businesses is more important than ever, and that openness in communication is a key factor in securing their trust. The message is clear: transparency can be a powerful tool to cultivate a trusting, loyal customer base—and even justify premium pricing in some cases.

In summary, operational transparency builds perceived value by revealing visible effort, cost transparency builds trust through sensitive disclosures of internal costs, and price transparency clarifies the structure of pricing, influencing perceptions of fairness. Each form of transparency uniquely affects consumer behavior and offers distinct strategic implications for businesses considering openness as a core strategy.

Final Thoughts: Transparency as a Strategy—Niche Feature or New Standard?

The recent spike in tariff surcharges reveals companies cautiously experimenting with transparency, betting that honesty—particularly regarding costs imposed by external factors—will resonate with consumers. Still, truly open disclosures about labor expenses, margins, or operations remain mostly confined to niche market players. Larger firms are understandably wary, preferring selective openness to maintain control over perceptions and avoid uncomfortable scrutiny.

Yet, consumer expectations can shift rapidly, and soon shoppers might routinely expect brands to disclose everything. In this scenario, transparency could become the corporate version of accidentally hitting "Reply All"—refreshingly honest, but deeply regrettable.

Thank you for the article, Prof. Allon. Makes me wonder if ‘for public good’ industries like Education and Healthcare, are better placed than other more ‘perceived as commercial’ industries to pioneer price transparency, given the nature of service they offer. Or does it work the other way around that such industries have a larger potential of consumer back-lash.

"and 73% say they would pay more for products with fully transparent attributes." I am highly suspicious about this study. I think it depends, and more likely if a customer sees that the company earns a high margin (subjective to each customer), their WTP will drop.