Long-time readers of this newsletter know that until a drone delivers coffee directly into my hand while I’m walking from the parking lot to my office, I won’t consider the word “convenience” fully achieved.

So, I was very excited to see this:

“South San Francisco-based Zipline presented its revamped home delivery system pairing the new fixed-wing Platform 2 (P2) drone with the final delivery droid, whose own onboard smart tech and internal propellers allow it to position over and touch down on even the smallest of spaces available at client destinations.”

For those unfamiliar with Zipline, they didn’t start with home-delivering burgers.

“Logistics startup Zipline has flown more than 38 million miles with its autonomous electric delivery drones since the company was founded in 2014. Zipline put its first fleet to work in Rwanda, delivering blood and other health supplies to clinics and hospitals. Since then, the Silicon Valley startup has expanded its service in six other countries, with limited delivery service and distribution centers in three states.”

This is somewhat related to the new legislation by U.S. Senators Mark R. Warner (D-VA) and John Thune (R-SD), who introduced the following:

“Increasing Competitiveness for American Drones Act of 2023, comprehensive legislation to streamline the approvals process for beyond visual line of sight (BVLOS) drone flights and clear the way for drones to be used for commercial transport of goods across the country – making sure that the U.S. remains competitive globally in a growing industry increasingly dominated by competitors like China.”

In a statement, Sen. Thune said the main motivation is that “Drones have the potential to transform the economy, with innovative opportunities for transportation and agriculture that would benefit rural states like South Dakota.”

While these two announcements deal with outdoor drones in particular, some of the most interesting applications refer to indoor drones:

“Ikea first partnered with the drone-making company Verity in 2020 to deploy the drones in Switzerland, but now, the company says they’re zipping around 16 locations across Belgium, Croatia, Slovenia, Germany, Italy, and the Netherlands. The Swedish furniture giant says the drones help improve the accuracy of product availability and also support ‘a more ergonomic workplace,’ as it saves employees from counting stock manually.”

“Verity, which specializes in creating self-flying drones for warehouses and even concerts, was founded by Raffaello D’Andrea, one of the creators of Kiva Systems, or what’s now called Amazon Robotics. As noted by D’Andrea in 2020, the drones work by taking off from a charging station and then going to each pallet in the warehouse to capture images, videos, and 3D depth scans of the items. Once the job is done, the drones return to their charging stations to download the collected data. The drones not only count inventory but also help employees determine if something’s missing or in the wrong spot.”

They look like this:

The impact on IKEA:

“As a result, one hundred busy drones are now at work during non-operational hours to improve stock accuracy and secure availability of products for online or physical retailing. This solution supports a more ergonomic workplace for IKEA co-workers as they no longer need to manually confirm each pallet.”

Why do I find this interesting? As consumers, we love to focus on the last mile. It seems more exciting. But maybe it’s time to look further within... Deep into our supply chains and their least exciting part… warehousing.

For the majority who will probably stop reading past this point, see you next week.

For the rest of you…

The Ever-Increasing Logistics Costs

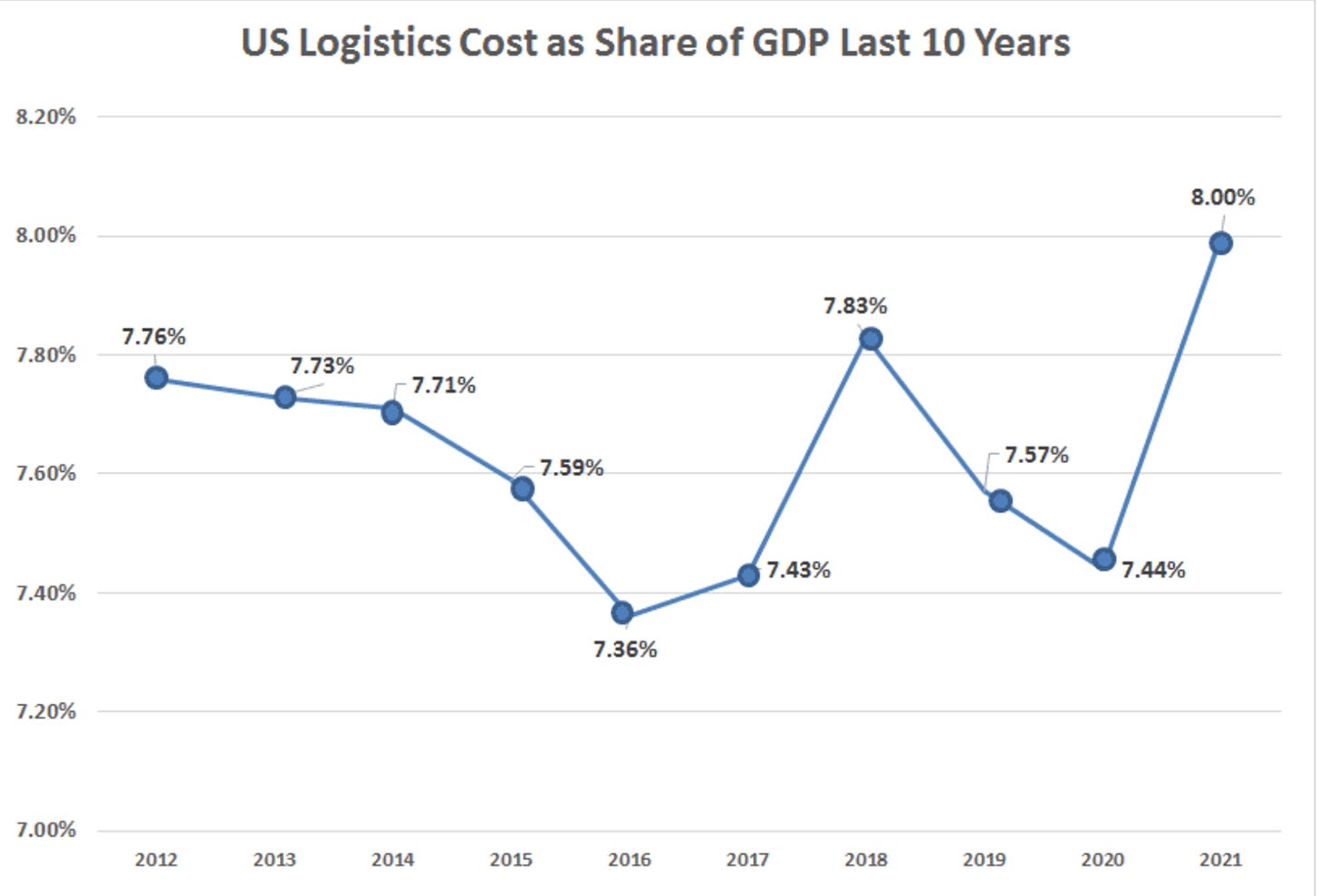

Recent years have shown a general trend of decreasing logistics costs as a share of GDP (despite the high costs associated with the rapid growth of e-commerce fulfillment). However, 2021 marked an end to this progress, with a noticeable jump in logistics costs.

According to an analysis by the Council of Supply Chain Management Professionals, the average annual growth in logistics costs, including inflation, has been 5.8% over the past five years. This increase in costs can be attributed to factors such as transportation and the cost of carrying inventory.

The article State of the Logistics Union 2022 points out that in 2012 (and through 2020), logistics costs in the US, ranged between 7.36% and 7.83% of GDP —a rather remarkable stability I would say.

“The peak in the past 15 years was 2007 (not on chart), when logistics costs hit 8.59% of GDP, close to where it was in 2008 (8.5%) before taking a steep drop in the recession year of 2009 to 7.4%. Since then, the numbers have been quite stable.”

Now, like everything else, you can see the glass as half full (given the increase in e-commerce, you would expect logistics costs to increase, but they haven’t) or half empty (there’s a lack of innovation in logistics driving it to grow at the same speed of spending).

You know me… I am a glass-half-empty kind of guy.

According to the report, transportation costs, the largest component of logistics costs (around 65% of the costs), increased by 21.7% in 2021 and have exhibited an average annual growth of 6.1% over the past five years.

Inventory carrying costs (usually around 27% of the costs), on the other hand, increased by 25.9% in 2021. While inventory levels fell last year, the costs associated with storing, handling, and financing inventory spiked.

The reality is that given the many years of just-in-time inventory management (where inventory levels were low and warehouse space ample), there was less pressure for productivity. As firms are potentially transferring their focus on proximity and convenience (and as capital and labor costs increase), the need to improve productivity in the warehouse is greater.

Warehousing and Logistics

If we want to understand the impact of drones, we need to understand how the costs of carrying and handling inventory are distributed between the different cost components.

The distribution of costs vary widely among continents:

In Europe and the US, rent amounts to 20%, labor to 32%, and equipment costs to around 7%.

But beyond the continent level, it’s interesting to look at the costs per country and see how they vary compared to the GDP. In the following graph, the x-axis represents the GDP per capita and the y-axis represents the logistics costs as a % of the GDP. You can see, for example, that while the US has a high GDP per capita, its logistics costs are only a small percentage (in case of confusion, note that the graph is from when Australia had a higher GDP per capita than the US):

It’s actually quite interesting that the higher the GDP per capita, the lower the logistics costs as a percentage of the GDP. In other words, the more productive a country is, the lower the fraction of its GDP stemming from logistics. If we view logistics as some kind of wasteful activity that creates friction, it makes sense.

Why?

Factors affecting logistics costs include transportation infrastructure (capacity and reliability), economic sector composition (relying on agriculture, mining, and manufacturing means higher logistics cost), information technology, legal systems, and regulations. As economies develop, logistics costs tend to converge and decrease. However, despite their high GDP per capita, some countries like Australia, have higher logistics costs due to the significance of specific sectors (e.g., mining).

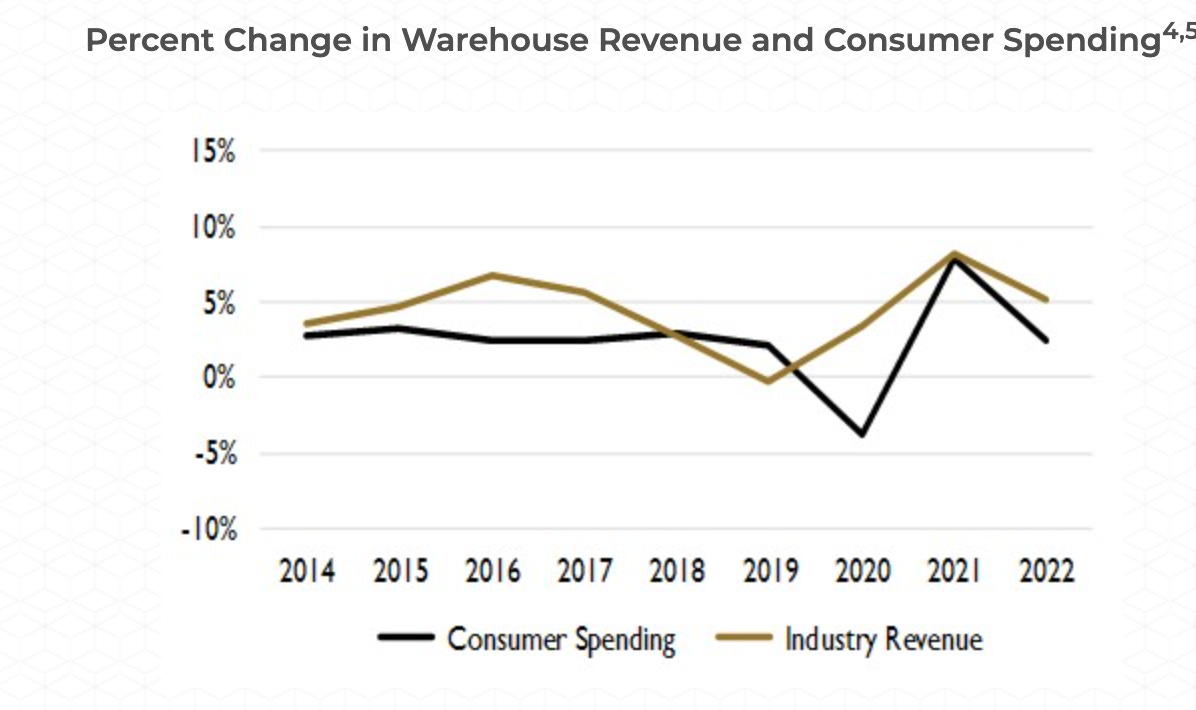

The second interesting aspect is that while we expect logistics costs to scale, this isn’t really the case. The costs trace consumer spending meaning they are linear to the economic activity they support (they increase/decrease similarly to consumer spending). We can see this in the following graph:

This may not be all that surprising once you realize that most of the components (and in particular, labor and utility) are linear in the act of handling inventory.

And we can’t disregard the impact of Covid-19. The pandemic-induced surge in online shopping strained the US transportation and logistics system, causing businesses to order safety stocks to ensure product availability. This led to a warehouse space race, as the country lacked sufficient storage facilities and workforce to meet demand. Rents for existing leases skyrocketed, and 96% of US warehouse space became fully occupied.

The Need for In-Warehouse Drones

But let’s get back to the drones.

It is exactly these expanding logistics costs and the increased demand for efficient warehouse management that have created the need for solutions such as in-warehouse drones. These drones are designed to perform various tasks within a warehouse, including inventory management, order picking, and transportation of goods. By integrating drone technology, warehouses can improve their productivity significantly and reduce their overall costs.

What do we gain from in-warehouse drones?

Improved Inventory Management: Drones equipped with cameras and sensors can quickly and accurately scan inventory and update warehouse management systems in real-time. This not only reduces the time and labor required for manual inventory checks but also minimizes the risk of errors. While we’ve discussed inventory accuracy before, it still seems to be an issue in 2023.

Enhanced Order Picking: Drones can streamline the order-picking process by identifying and retrieving items from shelves, reducing the time and effort required by human workers. This increased efficiency can help warehouses meet the demands of the growing e-commerce sector. Here, I would be remiss if I didn’t mention the work done at the University of Pennsylvania by Vijay Kumar (Dean of the Engineering school) and his lab, utilizing “Microdrones That Cooperate to Transport Objects”:

Reduced Transportation Costs: In-warehouse drones can transport goods within the warehouse, enabling faster order fulfillment and reducing the need for forklifts and other transportation equipment. This can result in significant savings in terms of energy, labor, and maintenance costs.

Increased Flexibility: Drones can easily be reprogrammed to perform new tasks or to adapt to changes in warehouse layout, making them a versatile solution for ever-evolving warehousing needs.

Using drones like the ones IKEA is adding for warehouse inspection, offers benefits such as time and cost savings, improved safety, and increased accuracy. Drones reduce the need for specialized equipment and labor, resulting in significant cost savings. They can identify potential problems, leading to lower maintenance costs and accident risks, which can potentially lead to savings on insurance costs. High-resolution drone imagery ensures thorough inspections, helping prevent more significant damages and further cost savings.

If 35% of costs concern labor, and those costs account for 30% of logistics costs, then approximately 10% of the overall logistics costs are driven by in-warehouse labor. If that can be cut in half, it’s a significant amount. If we can inspect inventory better, we can carry less, which yields financial savings (less working capital) and leads to occupying less space or more vertical space (lower rent).

How does any of this compare to using drones for delivery? Recent reports found that by 2026, drones will take over roughly 20% of deliveries. Analyzing sample data from a Minneapolis UPS delivery service, researchers at Rand found the firm would require 13 fewer trucks resulting in a net fuel savings of about 5.7%. If transportation accounts for 60% of logistics costs, and fuel costs are around 30% of these costs, then saving 5%, amounts to almost 1% savings on the overall logistics costs. Not very significant, but we can’t discount the impact on convenience, speed, and flexibility.

These computations make it evident that investing in drones is a long-term project. The improvements are incremental, but long-term, constant improvement requires firms to continuously engage in this exact type of investment.

And as for my on-demand coffee? That scenario may never be economically viable, but one can still dream.

Toys Don't Fly?

Thanks as always. Just walked by a “drone cafe” in Tokyo. There’s hope!